Developers, Builders Haven’t Defended Themselves from Bad Housing Policy

Developers, Builders Haven’t Defended Themselves from Bad Housing Policy

A couple of weeks ago I stumbled upon a glossy document online called, “The Decline of Seattle Townhomes Under MHA,” produced by the Master Builders Association of King and Snohomish Counties (MBAKS). The document is a slick looking analysis of the impact on Seattle’s tax on new housing called Mandatory Housing Affordability (MHA), an intervention that charges a fee per square foot for new housing that doesn’t include rent restricted units. More generically, the program is called Mandatory Inclusionary Zoning (MIZ), and I’ve called it bribery, an effort to extort cash from new housing and hand it over to non-profit tax credit developers. The document is, as the saying goes, “a day late and a dollar short,” and demonstrates how lack of ideas and courage by builders and developers plague the outcome of housing policy in the United States.

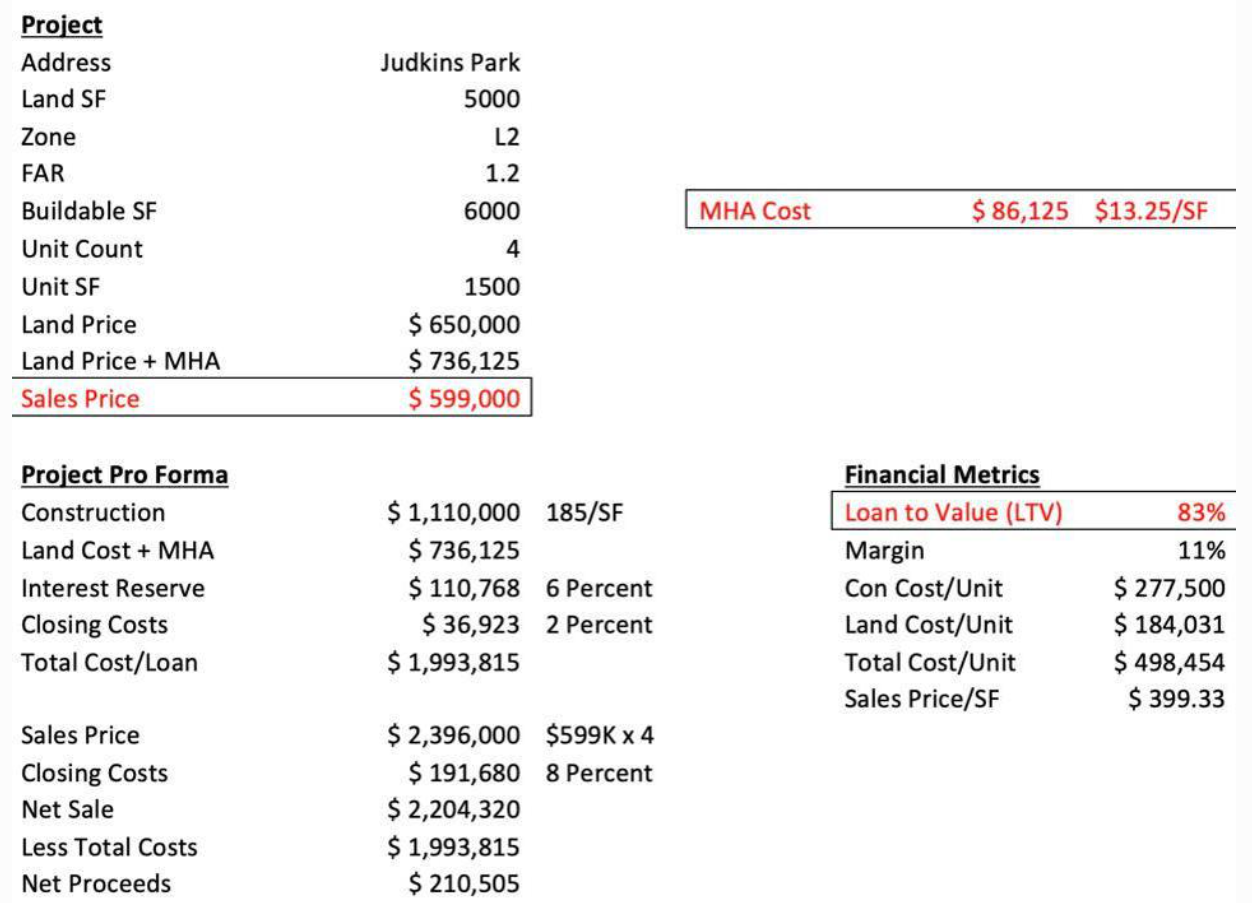

The report created by MBAKS gets it right: “Unfortunately, MHA fees are severely limiting new townhomes—a lower-cost, family-sized homeownership option. Post-MHA, townhome permit intake has dropped by nearly 70%.” The problem isn’t that conclusion, but that it took until the end of 2021 for the organization to reach it. I did a much less slick chart that shows exactly what happens to a 4-unit townhouse project when the fees associated with the MHA program are applied. An analysis was originally offered as a plea to stop MHA before it got any further down the road — back in 2016! What we already knew way back then was that fees would burden projects with a cost that would either kill the project or force the price to go up. Either way, people who need housing suffer either with a higher price, or lack of housing.

Judkins Park Case Study

This is an analysis of how MHA would kill development was done way back in 2016. Why did it take another 5-years for a local builders’ group to figure this out?

I was making this point over and over and over again since the proposal was first put on the table way back in 2015. Back then, the real estate arm of Paul Allen’s Vulcan company had come to a compromise on fees for its projects in downtown Seattle; why not just cut a deal and walk away (see my post linked above on bribery)? That should have been enough, but Vulcan and other big developers signed up for a deal, then called the Grand Bargain, that would impose the fee regime on all new housing development. The MBAKS represents smaller builders, not high-rise ones, and their point then was the same; imposing fees on smaller projects might kill them.

At the time, I remember fielding calls over and over again from builders who were looking at the looming fees and panicking. “I won’t be able to make my projects work with these fees.” The theory at the time was that buyers of land would hold out for discounts in the same amount as the MHA fees, rationalizing the additional costs. I was doubtful about that. And in a conversation with just such a developer I had this dialogue:

Me: So, what will happen when you look at a piece of land and consider the fees?

Him: If the price doesn’t come down or I can’t make the project work with the fees, I won’t buy it.

Me: You’ll just drive on.

Him: Yes. I either need to see a higher sales price or get a discount, otherwise nothing will happen there.

Yeah. Exactly. Have you ever tried to measure nothing? It’s kind of hard. It’s even more difficult when the City Government is collecting fees from bigger developers and smaller ones who have seen prices rise and now can rationalize the fees. As I pointed out in another post, the City has collected $96 million in fees and built about 700 units of housing. What’s the problem again? While the MBAKS waited until the damage was done, and now can make a decent quantitative argument that many units that might have happened didn’t, the City and non-profits can shrug and say, “We’ve built 700 units. And if you weren’t building anything, where did all those fees come from?”

My headline expresses my frustration and my realization that the notion that people who develop, finance, and build housing are not up to the task of defending what they do. In a way, that is a good thing. Unlike non-profit organizations on the left that get billions of dollars every year from people unburdening their consciences, private builders have to pay bills and create a return on their investment made with other people’s money. If they don’t, they go out of business. If they can hire an attorney and a lawyer and the result is a bribe they can pay, they’ll pay it and move on.

I have made this point before, and out of frustration I sent the plea to developers in this space a few years ago, in a post called “How to End The Housing Crisis:” “My message to developers has been, stop paying the exactions for short term certainty, take on the non-profits and demand they address rising regulatory costs and barriers, and invest in the intellectual project of persuading the public that yes, indeed, the earth moves around the sun and spins on its axis. That is what is true. So is supply and demand.

I am just the messenger, Joan of Arc, Cassandra, Laocoön. Or, perhaps, I am just Ripley. Believe it or not! The future of our housing economy is in the balance.” Last month I wrote a series strongly associated with the Aeneid, a classic of Western literature that deals with fate and fortune; Romans tended to associate fate with heroic efforts and fortune with defeat in battle. I think when it comes to housing, the issue is more influenced by the wheel of fortune than the loom of fate. If the numbers work, so does a new housing project; if it doesn’t nothing happens until costs go down or prices go up.

Those of us who advocate for rational solutions are dependent on the people who use rationality for their own business. The nature of what we call capitalism relies on the predictability and harmonization of rational and mutual self-interest. Yet it is this same rational self-interest that keeps developers and builders focused not on changing the world, but whether or not the project in front of them today will work tomorrow. Trade groups and organizations representing builders and housing providers must invest beyond that horizon, something they have yet to do.

WRITTEN BY ROGER VALDEZ

Roger Valdez is a public policy expert in the areas of education, health, and housing. Most recently he served as housing director at a large regional non-profit organization. He has been an advocate for progressive supply side solutions to housing scarcity. The opinions expressed in this article are those of its author and not necessarily the opinions of the Apartment Association of Greater Los Angeles. This article is being reprinted with permission from the author and was previously published by Forbes.