How Investors Can Use Delaware Statutory Trust Properties to Replace Debt in a 1031 Exchange

Presented by Kay Properties & Investments, LLC

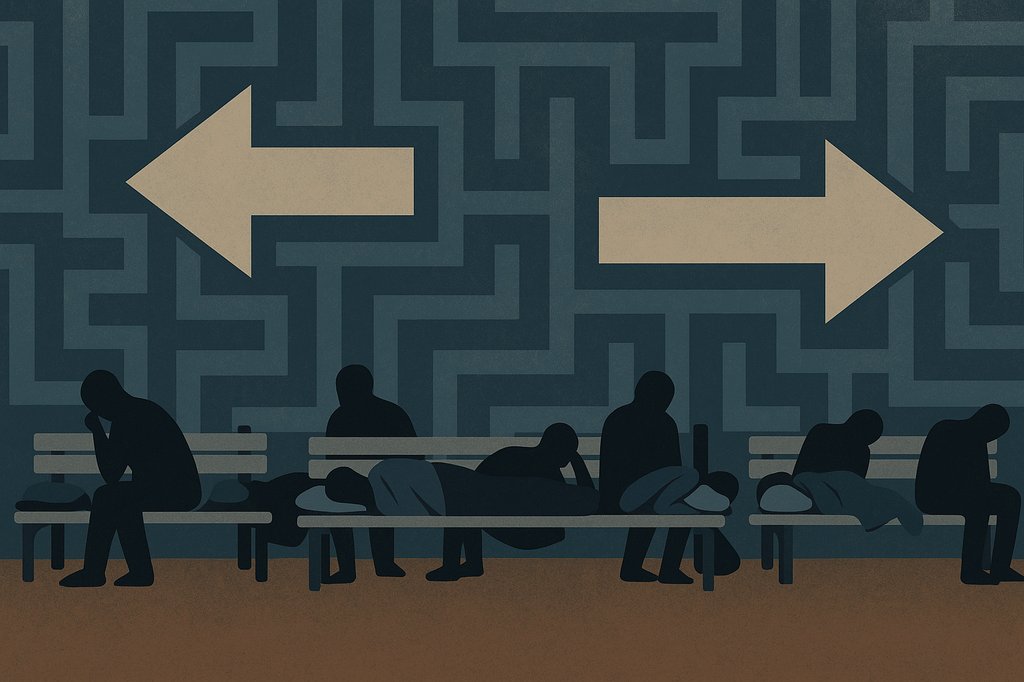

Navigating the nuances of 1031 exchanges can be confusing for real estate investors, especially when it comes to understanding the concept of debt replacement.

Many investors mistakenly believe that they must replace the exact amount of debt from their relinquished property to qualify for the tax deferral benefits of a 1031 exchange. However, the IRS regulations primarily focus on the value replacement, not necessarily the debt itself. This is where Delaware Statutory Trusts (DSTs) can provide investors a compelling solution.

Kay Properties’ Senior Vice President, Matt McFarland, considered one of the nation’s experts on 1031 exchange and DST investment strategies, will explain specific strategies investors can explore when looking to replace debt in their 1031 exchanges, including some practical benefits and ease of use that DSTs can bring to the table.

WEBINAR DISCUSSION TOPICS INCLUDE:

- What is a 1031 Exchange and the 1031 Exchange Value Replacement Rule?

- How can Delaware Statutory Trusts be used to replace debt in a 1031 Exchange?

- What are the types of leverage available in DST properties?

- DST investment and investor scenario examples.

- What are the 1031 Exchange Requirements for Replacing Debt?

- How can real estate investors avoid a “Boot” in a 1031 Exchange transaction?

- The value of Pre-Arranged Debt in Delaware Statutory Trusts.

- Types of Leverage (Loan-to-Value) in DST Properties.

- What are Some Specific Hypothetical Examples of Debt-Replacement Strategies?

GUEST SPEAKER: Matt McFarland, Senior Vice President, Kay Properties & Investments LLC

Matt is a Senior Vice President and works out of Kay Properties’ headquarters in Los Angeles, helping clients with their 1031 exchanges and direct investments. Prior to joining Kay Properties, Matt worked at a national commercial real estate tenant representation firm where he was involved in representing tenants in their leasing of commercial office, industrial and flex space. Since joining Kay Properties, Matt has participated in more than 2,000 transactions and over $15 Billion worth of real estate. Matt is known for his in depth knowledge of 1031 exchange strategies and the Delaware Statutory Trust investment structure, and is especially adept at educating clients on what particular investments make sense for their situation. A graduate of the University of California, Los Angeles, Matt holds a Bachelor of Science in Physiological Science from the UCLA Department of Integrative Biology and Physiology.