Insurance News: Important Coverage Update for Apartment Owners

So, here’s the scenario…let’s assume the unthinkable has happened – there’s been a fire and your building has sustained heavy damage! At least no one was injured. It’s going to be okay – you’d purchased insurance with a reputable company and made sure that you insured the building at its full replacement value.

The only problem is that insurance policies covering real property will only pay to replace WHAT YOU HAD. Think about that for a minute. What you HAD was a 3-story building constructed in 1967 with 15 units and 10 tuck-under parking spaces. But current code is going to require 5 additional parking spaces, additional handicap access, and upgraded structural elements that will add at least an additional $250,000 (or more) to the cost of construction.

The solution? That is where Ordinance and Law coverage (a/k/a, “O&L”) comes in to play. If you’ve heard of it – Congratulations, you are ahead of the game! If you haven’t, don’t worry – a lot of savvy property owners have not. And if you happen to know how much of Ordinance and Law coverage you have on your current policy then you can probably stop reading right here. But if you’re not familiar with the term or if you don’t know how much O&L is on your policy the rest of this article is for you. There are three parts to Ordinance and Law coverage and this article will touch briefly upon each. Most carriers refer to the three parts as parts “A,” “B,” and “C” although some will call them parts “1,” “2” and “3.”

Part A – Undamaged Portion of the Building

Let’s use the example of a $3,000,000 building that was 50% destroyed, where local building code requires that the undamaged remainder of the building be demolished. Your policy will not pay for the undamaged portion of the building that must be demolished unless you’ve purchased Ordinance and Law Coverage Part A. When purchased, “Part A” is usually written to the full value of the building. All buildings, new and old, can benefit from Ordinance and Law Coverage Part A.

Part B – Demolition

Your policy will pay for the hauling away of the rubbish and rubble created when half of the building was destroyed – but it will not pay to demolish the undamaged portion of the building and clear the site. For that you need to have an adequate limit of Ordinance and Law Coverage Part B. Coverage Part B is often written as a sub-limit of Part A. Some carriers will “toss in” a minimal amount – $25,000 or even $50,000 – of coverage. But one size doesn’t fit all. The cost to demolish a building can range anywhere from $4.00 to $15.00 per square foot or sometimes even more. We usually recommend purchasing at least 10% of your building’s replacement value in Part B coverage.

Part C – Increased Cost of Construction

It’s time to get building! Let’s look at some different possible scenarios.

- Let’s say your $3,000,000 building was 40% destroyed. Local building codes say you’ve got to bring the remaining 60% up to code at a cost of $150,000. Your standard replacement cost policy, even with a reputable insurer and full replacement value, will not pay the $150,000. (It also won’t pay the $100,000 to bring the damaged portion of the building up to code)

- Let’s say your $3,000,000 building burns all the way to the ground. It’s determined that the portion of the replacement cost attributable to bringing the building to code is $250,000. Your replacement cost policy would only pay $2,750,000 for the loss, leaving you to pick-up the tab for the remaining $250,000.

- Your building is completely destroyed, and local building code does not allow for the reuse of the foundation and pilings, underground pipes, flues, drains, grading, excavation, etc. Most carriers will not cover these items (presumably because they are not damaged during most covered causes of loss). Unfortunately, you now will need to add the cost of the underground work to the $250,000 increased costs of construction that will be coming out of your pocket.

To receive coverage for any of the above three scenarios, you will need to have purchased Ordinance and Law Coverage Part C. Coverage Part C, much like Part B, is often quoted as a sublimit of Coverage Part A. Carriers will often throw in a minor amount such as $25,000 or $50,000. We recommend buying as much Coverage Part C as you can reasonably afford. This does get tricky as some carriers will limit the amount that is even available for older buildings.

How Much Ordinance and Law Coverage Do You Really Need?

Consult with an insurance expert! Making this type of determination is usually outside the expertise of both building owners and insurance brokers. You can Google and come up with a general idea of demolition costs. And, as a rule of thumb for bringing a building up to code, it costs about 0.5% to 1% for each year of a building’s age. To get a really good idea of the values and costs involved; however, you should contract for a customized appraisal by a professional appraiser who is familiar with local building codes.

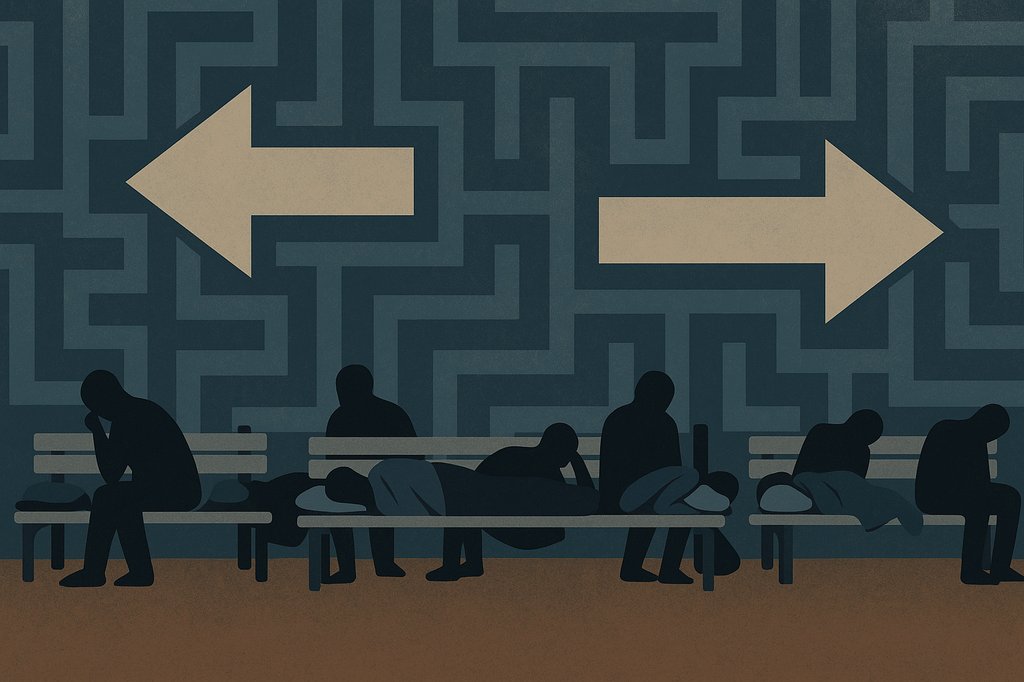

SoCal Commercial Insurance Services was founded with the firm belief that business owners want and need a trusted advisor to help guide them through the maze of coverage and policy options that are too often taken for granted. Given the current climate of financial uncertainty and the litigious nature of our times it’s never been more important to have the right policies in place to protect your life’s work. Please do not hesitate to reach our office if you have any questions about Ordinance and Law coverage or any other coverage questions at (310) 765-1650 or https://socalcis.com.