Real Estate: Strong Fundamentals Persist—As Do Opportunities: REITs should have several more years of solid growth in property fundamentals as the economic cycle continues and many sectors have the peak in supply growth behind them.

By Kevin Brown | Equity Analyst

U.S. Real Estate Outlook

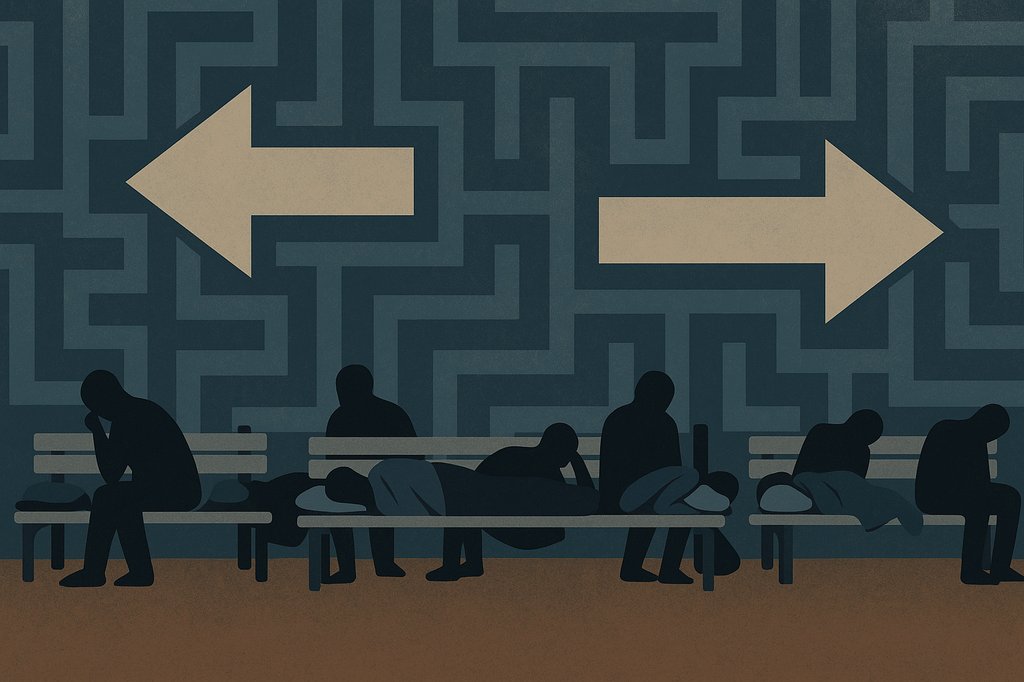

After falling in the first quarter due to pressure from rising interest rates, the U.S. real estate market performed in line with the broader U.S. market in the second quarter. The 10-year U.S. Treasury yield increased rapidly at the start of the year but has stayed near the 2.85% rate since mid-February, bringing relative stability to real estate stocks. Given the circumstances, many investors wonder whether we are near the peak of the commercial real estate cycle—higher interest rates could pressure growth rates, cap rates, return expectations, and ultimately asset prices. Also, to the extent that low interest rates have steered investors searching for higher yield and capital preservation toward REITs, the same funds could flow out of REITs if interest rates rise, further pressuring commercial real estate valuations.

However, rising interest rates also signal that the economy is healthy enough to support a rising interest rate environment. Continued economic growth will support the fundamentals of all commercial real estate. Real estate companies will benefit from the continued stabilization and growth of the acquisitions and developments they completed this cycle. Higher interest rates will make financing more expensive, not only reducing the return potential on new acquisitions and developments but also reducing the number of construction starts. REITs strengthened their balance sheets during the low interest rate environment, reducing near-term maturities and locking in low rates on long-term debt.

There is still a shrinking but significant spread between real estate cap rates and interest rates, which combined with growing net operating income supports current real estate prices. Future interest rate increases should be more gradual, and the growth of the underlying fundamentals should support current valuations.

The Trump administration could have an impact on several real estate sectors. Policies such as infrastructure spending, tax reform, general deregulation, and many other matters have extended the length of the current economic cycle. Additionally, several economic signals, including unemployment levels, wage growth, and GDP growth, support the case for positive momentum as we enter the back half of the year. However, the potential for a trade war with China could have an impact on several real estate sectors, particularly retail and industrials. Rising prices on steel and lumber would increase construction costs, making accretive development more difficult and reduce the number of construction starts for all sectors. Finally, increased immigration enforcement could increase labor costs, increasing expenses for industries that rely on immigrant labor, such as the lodging industry.

Much of our U.S. REIT coverage still enjoys healthy underlying operating performance. Historically high levels of occupancy and durable balance sheets characterize most portfolios. Although growth has slowed from elevated levels seen in recent years, we believe the market has been expecting this slowdown and has priced it into the sector. Supply has peaked and started to decelerate for sectors like apartments, industrials, and senior housing. Higher construction costs and tighter construction lending should reduce supply growth further even as demand continues to support fundamental growth through the cycle. Many firms have also continued to recycle capital, trading out of weaker, more vulnerable assets into stronger assets with better long-term growth prospects and risk profiles. Although near-term uncertainty has affected leasing and transaction volumes, private-market asset values have largely stayed intact and should continue to serve as an anchor for public-market valuations. Given that our real estate coverage is fairly valued as a whole, investors should enter the sector with caution. Our preferred investment vehicles are reasonably leveraged companies with solid prospects for long-term growth that can weather the natural cyclicality of the real estate markets.