Buying Real Estate: Measuring the Risks vs. the Rewards

By Christopher Miller, MBA

Specialized Wealth Management

Which investment is more desirable: one with a moderate projected return and moderate risk, or one with slightly higher income and slightly higher risk? The answer to that question depends on the investor who is asking and on his individual financial situation.

As a real estate investment advisor, I am always working with my clients to find the right properties for them; the investments that will best fit their personal risk/reward objectives.

The Goal of Investing

As investors, we seek ventures that fit our goals and risk tolerances. Real estate is my favorite investment vehicle since it offers the potential for income – with tax benefits – during the hold period and the opportunity for great appreciation; particularly when leverage is used.

If I had $1 million of cash to invest today and invested it in stocks, would I be surprised if they were worth $600,000 next year? I shouldn’t be. That is what stocks do; their values are volatile and can swing wildly. What will these stocks be worth in 10 years? More, I hope. Hope is the key word in that phrase, since it is virtually impossible to build a financial model to predict stock market returns.

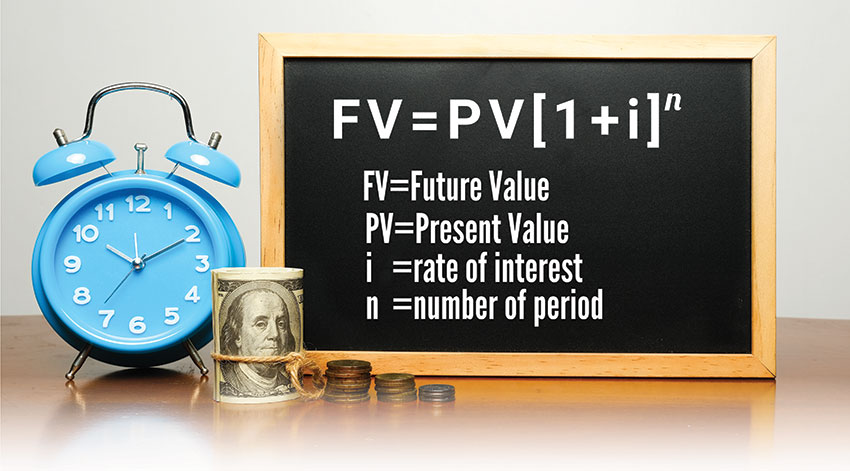

Let’s say, on the other hand, that I invested that $1 million in real estate. While I certainly could not be sure that the property would still be worth what I paid for it next year, I would be confident the property would rise in value over the next decade. Prior to purchase, I would create a financial model using reasonable projections to help me forecast this. For example: I can put $1 million down on a $2,000,000 property and borrow the rest for 30 years at 4%. For our 10-year re-sale projection, we will estimate that rents and expenses grow at 4% annually. If I bought at a 5% CAP Rate and sold at a 6% CAP, this would give me a potential sales price of $2,900,000. Since the loan balance will have decreased to $760,000 by then, I am left with $2,151,000 of sales proceeds – doubling my money over 10 years.

This is why I like real estate investing so much. If I create a model and use reasonable assumptions, I can make projections that help me feel comfortable about the investment. I realize that there is always a risk – but the potential reward makes this risk worth it. I didn’t start my article this way to give stockbrokers a hard time or to convince you to buy real estate investments. As you are reading a publication that caters to landlords, I know that I am preaching to the choir. Although there are many risks in buying real estate, I wanted to focus on a few specific ones this month:

Income Risk

Income risk refers to the risk we are taking that our income will continue. In the case of Net Leased Properties – will the tenant keep paying rent? If the tenant’s lease expires, will they renew? If not, what are our prospects for finding another tenant to move in and keep the income coming? We can address these risks by sticking to tenants with strong credit and long-term leases. Additionally, we will want to buy in robust metropolitan areas to make re-leasing the property as easy as possible: should we ever need to do that.

In apartments, will we be able to keep occupancy and rent levels high enough that we see a profit every month after the bills are paid? Will unexpected expenses impact our future income? A careful analysis of the property and its surrounding market is needed here. After a thorough inspection of the improvements are done, future costs of any capital expenditures (large maintenance jobs) need to be estimated. My managers will typically create a reserve fund to pay these costs over the ownership period.

Inflation/Appreciation Risk

If your money isn’t growing, it is shrinking – thanks to the power of inflation. I’ve never been a big fan of bonds because, when I buy a 10-year bond I’ll pay $1,000 (If I buy at par.) When the bond matures, I get my $1,000 back – but it is not worth as much as it was when I paid it 10 years before. The income I receive from the bond needs to make up for this difference. If a California 10-year municipal bond has a yield to maturity of 3%, will that be enough to cover inflation and provide a profit for us? I don’t think so.

While we want to be confident that the income from our properties will rise to beat inflation, we want the same for our property values. I buy real estate for income and growth – and I expect to see both from my properties. How can we give ourselves the best chance to achieve both? For Net Leased properties, we need to take a look at the rent increases that the lease contains. If there aren’t any rent increases, we likely don’t have much appreciation potential. In apartments, we can stay ahead of inflation by purchasing in growing metropolitan areas. Rising demand for housing, a growing population and growing employment could continue to create growing rents and growing value for us.

Leverage Risk – To Borrow or Not to Borrow?

When I borrow money to buy a property, my #1 risk is that the property’s income decreases, I cannot pay the mortgage, and the bank takes my property from me. So any property that is bought with a loan certainly carries more risk than one without leverage. There are, however, significant benefits to using leverage that many of my investors find makes it worth this risk.

The largest benefit is depreciation: When I sell a property that was fully paid off, I have likely used all my depreciation, so I get zero tax benefits every year. Buying a property with leverage, through a 1031 exchange, will allow me to do what the IRS calls buying new basis: the amount of property purchased by the loan can then start being depreciated immediately. If I sell a property for $1 million and leverage it at a moderate 50% to buy $2 million of property, I just bought $1,000,000 of this “new basis,” which gives me $29,090 of annual tax deferral for my income.

Leveraged properties can give us the opportunity to see greater appreciation, as well. If I buy a $1,000,000 property with cash and sell it for $2,000,000, I have doubled my money. If, on the other hand, I buy that property with a $500,000 down payment and a $500,000 loan, I just turned $500,000 into $2 million – that’s four times my money. And what could my investment with the remaining $500,000 of equity done as well? Using leverage to compound our appreciation potential is what made us so successful in real estate over the years.

All investments involve balancing risks. How much return do you want, and how much risk do you want to take to get it? These questions should be carefully considered before making any investment. If you have any questions, my office phone number is (877) 313-1868.

Christopher Miller is a Managing Director with Specialized Wealth Management and specializes in tax-advantaged investments including 1031 replacement properties. Chris’ real estate experience includes work in commercial appraisal, in institutional acquisitions for a national real estate syndicator and as an advisor helping clients through over four hundred 1031 Exchanges. Chris has been featured as an expert in several industry publications and on television and earned an undergraduate business degree and an MBA emphasizing Real Estate Finance from the University of Southern California. Chris began his real estate career in 1998. Call him toll-free at (877) 313 – 1868.

Securities offered through Emerson Equity LLC, member FINRA/SIPC. Emerson Equity LLC and Specialized Wealth Management are not affiliated. All investing involves risk. Always discuss potential investments with your tax and/or investment professional prior to investing.