COLLECTING LOST REVENUE

Owners and Managers Partnering with

Collection Firms to Recover Lost Revenue

Increasing Profitability and Productivity for Owners and Managers

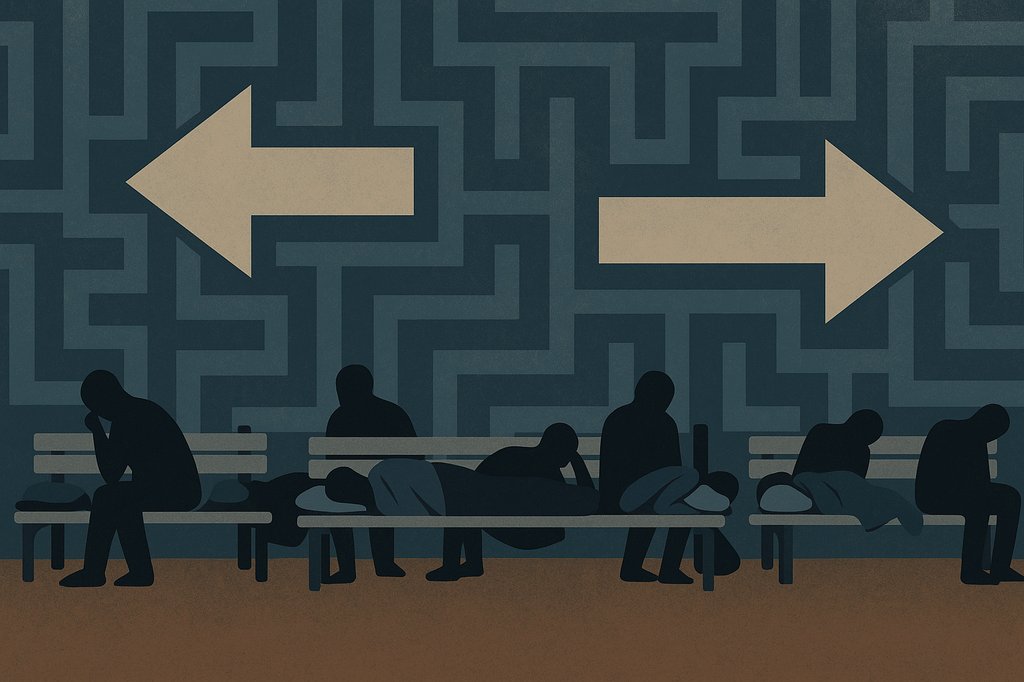

Owners and managers of multifamily housing properties are increasingly partnering with collection firms specialized in the intricacies of the industry to collect lost revenue. The outsourcing of this function to experts in the industry allows owners and managers to focus on their core competencies while also more efficiently retrieving valuable funds.

Property owners and managers with uncollected rent face diminished revenue of one to three percent annually, which can significantly impact the profitability of multifamily property. This issue often goes overlooked because on the surface it may not seem significant. However, an owner with only 100 units with rent at $800 per month loses nearly $2,400 (at three percent) in a year. When an owner wants to grow his or her business and increase profits by two to four percent annually, a revenue loss of three percent requires an additional five to seven percent in additional revenue to net the original growth goal.

How Big Is The Problem Of Uncollected Rent?

Owners who do nothing to collect past-due rent are leaving money on the table and in turn losing out on additional revenue. Default renters can cost everyone money. While many believe an improving economy will ease this significant issue, recent numbers reveal an alarming trend. For the first time in our nation’s history, Americans’ consumer debt has topped the $2 trillion mark, and billions of dollars are still uncollected, many of which include rent payments. (Source: Federal Reserve Statistics).

Adding to the already difficult issue of increasing consumer debt is the fight against time a majority of owners face. Research shows the longer a debt goes unpaid, the less likely a property owner or manager will be able to collect it. (Source: Collection Agencies Services) Specialized firms who are committed to focusing their time on only the issue of debt collection increase the likelihood of retrieving a portion of the debt, if not the entire amount. With the additional revenue received from successful debt collection, property owners can increase their property value but more importantly their bottom line.

Why Is Multi-Family Debt So Hard To Collect?

An experienced firm specializing in the complexities of multifamily debt will achieve the highest success for owners with uncollected rent. Multifamily debt is very distinct and complex. Debt associated with the multifamily industry is among the most difficult to recover for a variety of reasons:

Resident debtors tend to be more transient; they move and change jobs more often and rarely leave forwarding addresses or phone numbers, so locating them is often the most difficult aspect of the collection process.

Debtors are not homeowners, so there are no easily attachable assets.

A majority of multi-housing debts are disputed; debtors often claim the co-resident is responsible, or that the charges are excessive or arbitrary—usually due to a lack of understanding of the lease agreement. Medical or credit card debts, on the other hand, have minimal dispute rates and are therefore more collectible.

The rent payment is the last thing to go unpaid, because more is at stake (losing shelter). When debtors stop paying for their shelter, they are usually in extreme financial circumstances and are less likely to have the capacity to pay, even if they are willing.

A collection firm must possess the expertise and experience to handle intricate issues surrounding multifamily accounts. Also, proper training is crucial when dealing with this type of debtor, especially if the account has aged. A professionally trained collector becomes efficient at developing excellent problem solving and effective communication skills with which to handle multifaceted accounts. Professionally trained collection representatives must exhibit tact, persistence and an understanding of people’s motivations, which in turn will produce more dollars collected for owners.

If necessary, professional collection firms can take a debtor to court, however this is used only as a last resort. In such a transaction-rich industry, accessing excellent legal advice is an absolute prerequisite for success. Owners who use the services of a specialized collection firm are shielded from any exposure or negative effects of suits.

The Days Of ‘Dialing For Dollars’ Are Long Gone

The modern collection firm uses a sophisticated array of technology, systems, specialized training, monitoring and reporting to deliver maximum results in the least amount of time. A professional firm will have an attorney and compliance officer on staff to ensure adherence to federal and state regulations designed to protect the consumer, like the Federal Trade Commission’s Fair Debt Collection Practices Act (FDCPA). According to ACA International, third-party collection services that use specialized phone systems, computer and software designed specifically for the collection industry, usually are more effective than creditors at collecting payment on delinquent accounts.

An experienced, specialized collection firm relieves property owners and managers of the overwhelming administrative work of debt collections while dramatically increasing profitability. A specialized collection firm should also provide detailed reporting systems designed to help owners and managers make better leasing decisions and assist them from the onset in reducing future bad debts.

When it comes to uncollected rent, an experienced collection firm can assist owners in retrieving as much revenue as possible from residents in default. Property owners who want to increase their efficiency while growing their bottom line will profit from a partnership with a professional collection firm specializing in the multifamily industry.

About the Author

Stephen Sobota is CEO of Hunter Warfield, Inc. and can be reached at ssobota@huntwar.com. Hunter Warfield, Inc., an incorporated affiliate of Pierce Hamilton & Stern, provides debt collection services to clients in a wide range of industries from multi-housing to funeral services to commercial business. Focused on superior customer service and advanced management practices, Hunter Warfield is committed to taking collections to a new level. Through innovative technology and flexibility, we are unmatched at providing comprehensive collection solutions tailored to meet each customer’s evolving business needs. More information is available at www.HunterWarfield.com.