Easier 1031 Loan Replacement with Partial Interest Properties

Most of my real estate advisory clients are completing 1031 Exchanges and need to replace debt in order to effect a completely tax-deferred (potentially forever) 1031 Exchange. Sometimes applying for and securing a new loan can be a laborious process. Partial Interest properties represent an alternate way to secure financing. We will explore this topic in depth this month.

What is Debt Replacement in a 1031 Exchange?

A 1031 Exchange investor, in order to achieve a completely tax deferred exchange, must replace all of the equity received and all of the loan paid off from his sale. Let’s say our investor sold his property, after expenses, for $1 million and paid off a $400,000 loan at the time of sale, leaving him with $600,000 of equity in his exchange accommodator account. To defer all taxes from this sale, he must spend $600,000 of equity on a new property and assume a loan of at least $400,000. Any unspent equity or “un-replaced” debt will be considered “taxable boot” by the IRS.

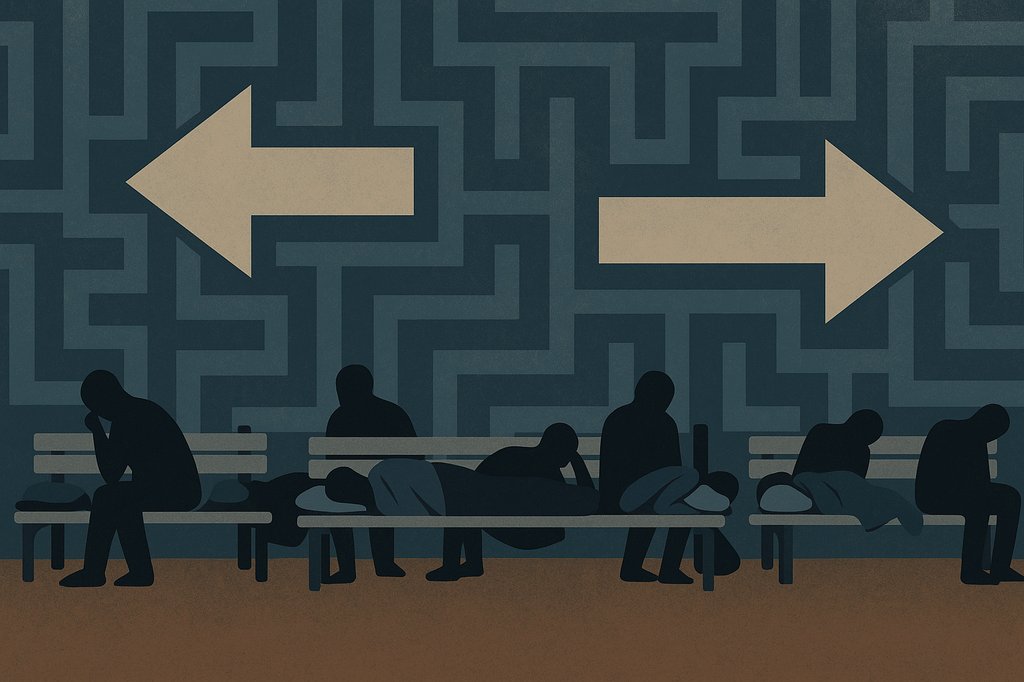

Sometimes Loans Can be Tough to Get

Sometimes high interest rates and high purchase prices (like we are seeing today) can unfavorably skew debt service coverage ratios, making it difficult to qualify for the amount of loan an investor may need. Other times an investor is selling a smaller property in his portfolio and doesn’t feel up to the lengthy time and energy consuming process that applying and qualifying for loans entails. Partial interest properties, with their in-place permanent financing, can be a solution for these investors.

Loans on Partial Interest Properties are Turn-Key

With a partial interest property a management company will buy, for example, a 300-unit apartment property in Dallas or a CVS Pharmacy in the Atlanta suburbs. The manager will then arrange a permanent loan for the property and sell the equity portion of the building to investors. An investor putting up 1% of the equity will get credit for 1% of the loan and therefore buy 1% of the property. Because this is a non-recourse loan; the loan is to the property and not the investor – so no personal information, tax returns, or lengthy loan-closing signature packages are necessary. An investor can select a property on Monday, close by Friday and complete his exchange. He can start receiving his potential income immediately as well – as soon as the middle of the next month after closing.

How This Would Work for Our Example Investor

Our investor above, with $600,000 of equity and $400,000 of debt to replace, can purchase part of a $100 million apartment property in Dallas that is leveraged at 45%. This 45% figure represents a “loan to value” ratio that is most easily explained as the opposite of your down payment. (If I bought my first house with a 20% down payment, that means the other 80% was bought with a loan – for an 80% loan to value ratio.) So these Dallas apartments cost $100 million and include a $45 million permanent loan.

My client’s $600,000 equity investment would also include $490,909 of debt, which gives a total of $1,090,909 of property purchased. ($600,000 / (1-.45)) Since this exceeds the required numbers above, our investor has completed a completely tax-deferred (potentially forever) 1031 Exchange. Additionally; since he, by using the loan he was given credit for, bought $90,909 more property than he “needed” – the IRS will call this “new basis” that he can start taking full depreciation deductions on.

“Off Balance Sheet” Loans that Won’t Affect Your Access to Credit in the Future

As mentioned earlier, the loans on the partial interest properties I deal with are all fixed-rate and non-recourse. Non-recourse means that, in a worst-case foreclosure scenario, the lender’s only recourse to a default is the property itself. If they loaned $30 million on a property and could only sell it for $20 million, then they lose that $10 million – that’s part of the deal. Therefore, since a partial interest investor isn’t “on the hook” for that outstanding loan amount, it won’t appear on his credit report, doesn’t need to be included on his balance sheet and won’t affect his access to more credit. (In case he would like to buy more real estate in the future with credit.)

For almost 25 years, my clients have used partial interest properties as an easier way to replace debt in their 1031 Exchanges. Could a partial interest property help you? Can my office at (877) 313-1868 to learn more.

Written by By Christopher Miller, MBA Specialized Wealth Management

Christopher Miller is a Managing Director with Specialized Wealth Management and specializes in tax-advantaged investments including 1031 replacement properties. Chris’ real estate experience includes work in commercial appraisal, in institutional acquisitions for a national real estate syndicator and as an advisor helping clients through over five hundred twenty-five 1031 Exchanges. Chris has been featured as an expert in several industry publications and on television and earned an undergraduate business degree and an MBA emphasizing Real Estate Finance from the University of Southern California. Chris began his real estate career in 1998. Call him toll-free at (877) 313 – 1868.

Securities offered through Emerson Equity LLC, member FINRA/SIPC. Emerson Equity LLC and Specialized Wealth Management are not affiliated. All investing involves risk. Always discuss potential investments with your tax and/or investment professional prior to investing.