How To Create a Diversified Delaware Statutory Trust (DST) Portfolio

By Jason Salmon, Senior Vice President, Kay Properties & Investments, LLC

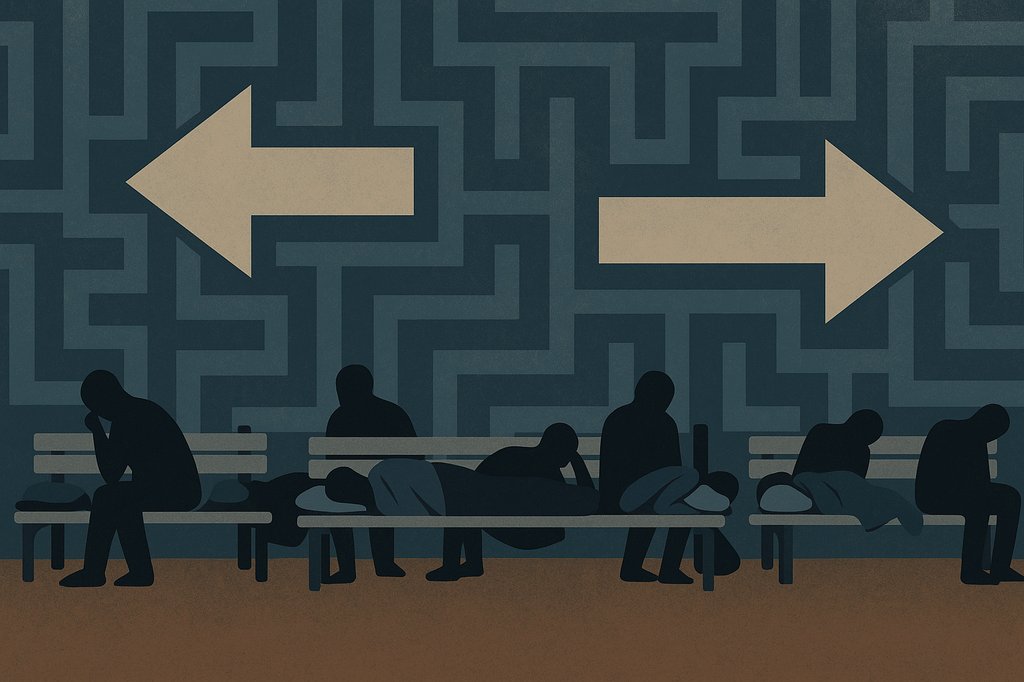

Diversification is one of the basic building blocks to any investment portfolio strategy. It is the simple concept of not wanting to put all your eggs in one basket. Diversification across asset types helps to avoid concentration risk – and potentially a basket full of broken eggs. Diversification also has the potential to create other positives, such as achieving a potentially higher overall blended return for a portfolio and smoothing out the natural cyclical ups and down that can occur within sectors.

Real estate is an alternative asset that is often used to diversify investment portfolios. Investors also can create diversification within those real estate allocations to achieve some of the same positive results. Delaware Statutory Trusts (DSTs) are ideally suited to build portfolio diversification. For example, if an investor has $1.0 million to invest in a 1031 Exchange, it can be difficult to find even one property to buy at that price, let alone multiple properties. In comparison, the fractional ownership structure of DSTs gives investors a variety of choices to diversify that $1 million into multiple investment properties. Because DSTs are a passive investment structure with no day-to-day management responsibilities, an individual can easily build a diverse portfolio that contains multiple DSTs without adding any additional work or time commitment.

Regardless of whether an investor has $200,000 or $25 million to invest in DSTs, it is very easy to build a diverse DST portfolio. An investor with $200,000 could split that investment into four DSTs at $50,000 each. Even for an investor who only wants to invest in triple-new lease (NNN) properties, he or she can still choose assets with vastly different characteristics. For example, that investor could invest in a Walgreen’s, a FedEx distribution center, a portfolio of Tractor Supply stores or a portfolio of Amazon distribution facilities. The fractional ownership structure allows the investor to stretch their dollars across multiple assets. In addition, DSTs offer an efficient closing process that makes it easy to execute their 1031 Exchange, even across multiple investments, all within the allowed time period and often much sooner as DSTs can typically be closed on within 3-5 days.

Many individuals who are investing in DSTs are buying multiple DSTs. Everyone is unique in how they choose to diversify investment holdings, and there are many different options to achieve diversification and a balanced potential income stream. Some examples include:

- Property Type: Kay Properties offers investors a variety of property types on the www.kpi1031.com marketplace with options that include apartments, multifamily, industrial, manufactured housing, self-storage and NNN assets.

- Geographic: DST properties are available across the country in different regions and markets, including primary, secondary, and tertiary cities.

- Resilient or “recessionary resistant” types of uses. Think industrial e-commerce distribution facilities or essential dialysis treatment centers.

- Single Asset vs. Portfolio Deals: Portfolio deals are not necessarily better or worse than a single asset DST, but a portfolio DST does offer an additional layer of diversification.

- Credit quality of the tenant(s), including investment grade and non-rated tenants.

There is no one single solution or strategy for creating a well-balanced and diversified DST portfolio and avoiding some of the pitfalls associated with concentration risk. Every investor is different. Some do like to keep things simple with fewer holdings or investing only in one type of property. However, one of the qualities that attract investors to DSTs in the first place is the ability to easily invest across multiple DSTs – even if they do not have a large amount of capital to invest. It is important for investors to work with their Kay Properties team members to find deals that make sense for their unique situation and build a diversified portfolio that aligns with their overall investment goals, risk tolerances and objectives.

Kay Properties is a national Delaware Statutory Trust (DST) investment firm. The www.kpi1031.com platform provides access to the marketplace of DSTs from over 25 different sponsor companies, custom DSTs only available to Kay clients, independent advice on DST sponsor companies, full due diligence and vetting on each DST. Kay Properties team members collectively have over 115 years of real estate experience, are licensed in all 50 states, and have participated in over 15 Billion of DST 1031 investments. For a look at the types of DST properties investors are using for estate planning purposes please visit the Kay Properties marketplace at www.kpi1031.com. This material does not constitute an offer to sell nor a solicitation of an offer to buy any security.