Jumbo “Affordable Housing” Bond Dropped from San Francisco Bay Area Ballot

In an unlikely victory against government excess in the ultra-liberal Bay Area, a regional housing authority has decided to remove a $20 billion housing bond from the November ballot.

If successful, Regional Measure 4 (RM4) would have been the largest local government bond initiative in American history. Led by the Bay Area Housing Finance Authority (BAHFA), the measure’s backers said they would build or preserve 72,000 affordable housing units across the nine-county region surrounding San Francisco.

Now it’s dead, the victim of an all-volunteer effort.

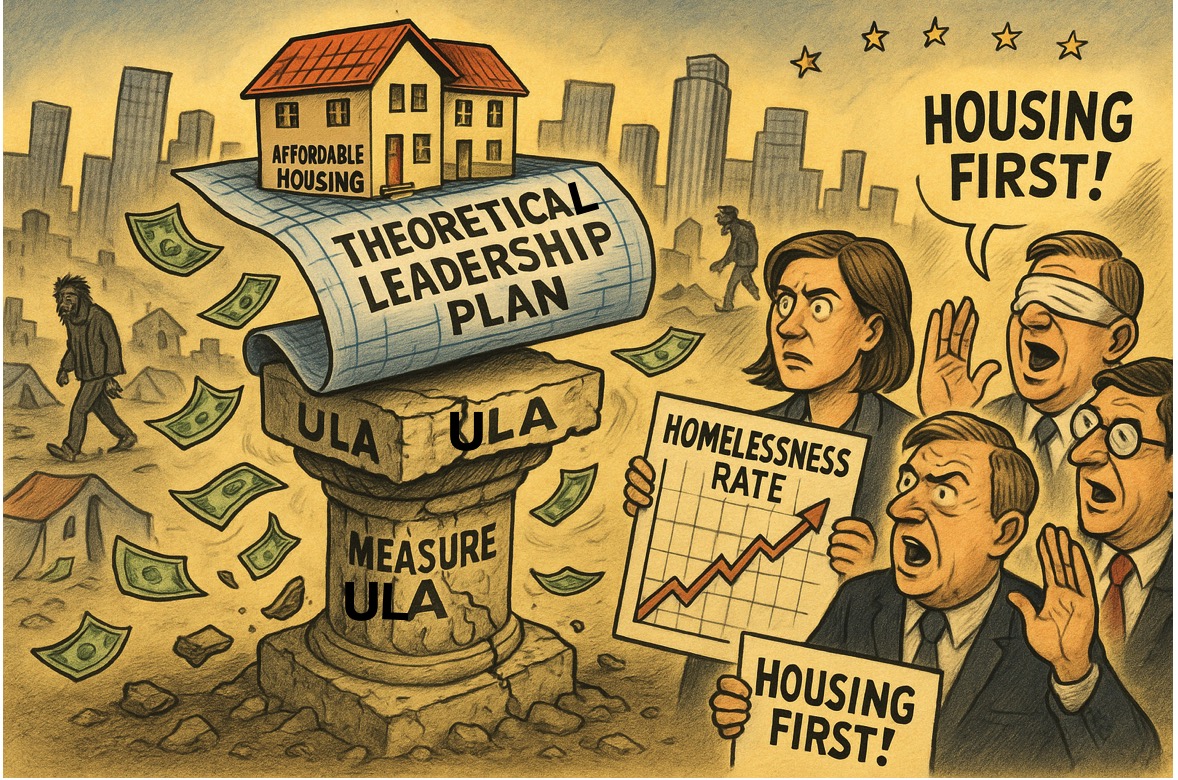

The California state legislature created BAHFA to solve the region’s housing affordability problem in 2019. Instead of focusing on the problem of government regulation, BAHFA, operating in connection with two other regional agencies, settled immediately on a single solution: government housing subsidized by a massive bond program.

But although BAHFA had more than four years to develop RM4, the measure had serious flaws. Most egregiously, the ballot language contained a huge mathematical error, quoting annual bond debt service at $670 million rather than the correct amount of just under $911 million. BAHFA also misleadingly called RM4 the “Bay Area Affordability Plan,” when, in fact, it would have made the Bay Area less affordable for the millions who pay property taxes directly or indirectly through their rent.

These and other misleading statements in the RM4 ballot language attracted a lawsuit from several Bay Area taxpayers (including this author). Although BAHFA conceded the mathematical error, it was still fighting other wording changes demanded by the lawsuit when it finally pulled the plug on August 14.

It’s hard to know precisely why proponents abandoned their initiative — hard but not impossible. In the Spring, BAHFA’s own pollster (hired at a cost of at least $133,500) showed RM4 was polling just below the necessary 55 percent threshold required for passage. Then came the lawsuit and attendant negative press coverage as well as audits showing government mismanagement of homeless programs, and reports of affordable housing costing more than $1 million per unit all of which likely soured Bay Area voters.

More recent but unpublished BAHFA polling apparently showed support had slipped a few points since then.

BAHFA and its supporters were also surprised by the appearance of an opposition group. Falsely assuming that all Bay Area fiscal conservatives had moved, retired, or died, they incorrectly concluded that they could act with impunity. The homelessness industrial complex’s arrogance and sloppiness created a target-rich environment for opponents.

For example, the bond measure had an unusual 53-year repayment period instead of the more standard period of 25-35 years we see in most school bonds. I believe this was done to reduce the annual debt service cost per $100,000 of assessed value, which most voters treat as the sticker price of a bond measure. RM4 came in at $18.98 per $100,000 but probably would have been over $20 if a more appropriate repayment period had been used.

While the long amortization period reduced the annual cost of servicing bonds, it increased the lifetime cost of the program. Total interest alone would have been $28.3 billion, more than double the $20 billion principal value of the bonds.

There were no components of the bond program that would have constrained the cost of building the affordable housing. It was clear from BAHFA meeting proceedings that the intention was to build in densely populated areas, using unionized labor working for prevailing wages under project labor agreements. Perhaps because the housing “had to” be near transit, a disproportionate amount was to be built in San Francisco, the highest-cost location in the Bay Area.

BAHFA’s approach satisfied developers, unions, transit advocates, and homelessness non-profits at the expense of creating an even minimally cost-effective program.

A more fiscally responsible program would have focused on manufactured housing in outlying areas with lower land-acquisition costs. Better yet, BAHFA could have proposed policies that would lower the cost of building market-rate housing, making homes affordable to a broader range of Bay Area residents without saddling everyone with years of bond repayments.

One can hope that BAHFA will come back with a less bad program in 2026, but somehow I doubt it. Rather than reach out to the opposition, I expect that they will fall back on their supporters to give us another misbegotten program.

Shared by California Policy Center. Written by Marc Joffe, Visiting Fellow.

Marc Joffe is a federalism and state policy analyst at Cato Institute and a California Policy Center visiting fellow.

After a long career in the financial industry, including a senior director role at Moody’s Analytics, he transitioned to policy research at CPC and Reason Foundation. Joffe’s research focuses on government finance and state policy issues.

Marc earned an MBA from New York University and an MPA from San Francisco State University.