Misunderstanding And Inconsistency: The State Of Fraud In The Rental Housing Industry – Property Management Companies Lack A Layered And Systemic Approach To Fraud

A Forrester Consulting Thought Leadership Paper Commissioned By TransUnion

A Forrester Consulting Thought Leadership Paper Commissioned By TransUnion

In today’s property management environment, rental applications have mirrored our desire to do more online and less in person. However, with this increase in accessibility and convenience comes risk — which property management companies are not appropriately prepared for. Unbeknownst to them, the housing industry is experiencing an intense increase in fraud, and current fraud identification methods have not been able to keep up with today’s savvy fraudsters.

The vast majority of property management companies, 83%, have experienced fraud up to 20 times in the last two years.

To protect their reputations and pockets, companies must implement robust technology solutions that identify, mitigate, and prevent fraud while easily integrating with the other systems in place. The alternative? Property management companies will continue to lose financially and reputationally to fraudsters.

In June 2018, TransUnion commissioned Forrester Consulting to evaluate fraud in the rental housing industry. To explore this topic, Forrester conducted a study with regional managers and above who have oversight on a portfolio of assets within a multifamily or single-family property management company. We found that fraud is prevalent and spreading with the rise of online applications and increasingly sophisticated fraudsters.

KEY FINDINGS

– Rental fraud is growing. The rise of online rental applications has increased the amount of fraud that property management companies are experiencing, leaving them unprotected and scrambling to react to constantly evolving fraudsters.

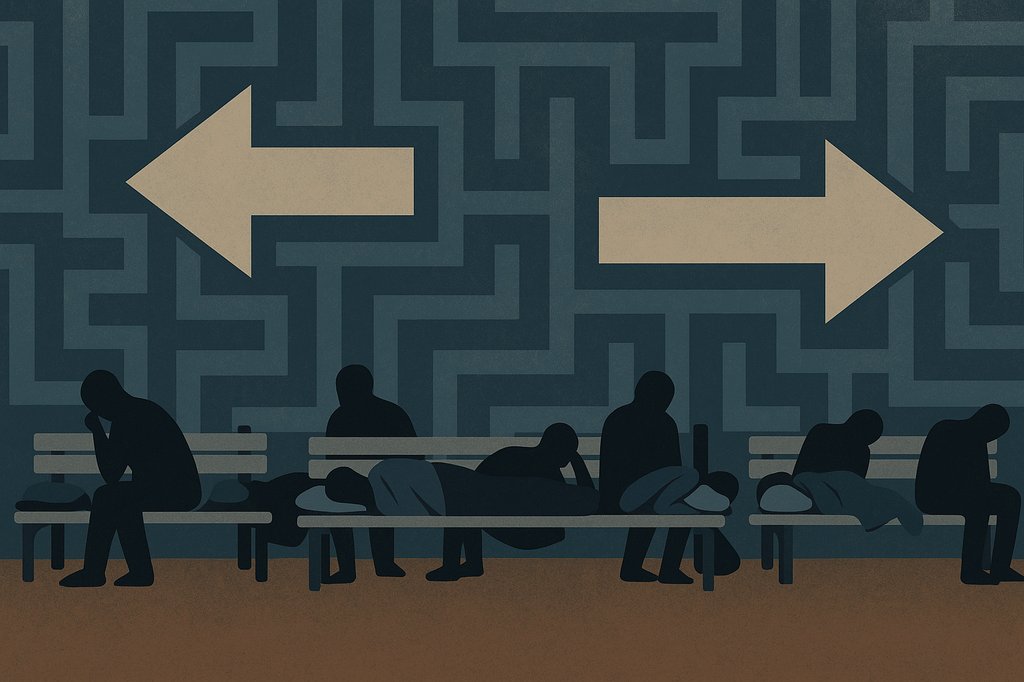

– Fraud prevention today is reactive, not proactive. Most experience fraud after move-in — an indication that the damage could have been prevented if companies had the right tools in place. But most rely on manual processes to identify and prevent fraud, leaving gaps in protection and creating a largely reactionary strategy. And what makes matters worse is that firms don’t have a clear understanding of the differences between the applicant screening process and fraud mitigation; conducting a background check or scanning a driver’s license does not equate to fraud prevention.

– Property management companies need tools that are advanced enough to proactively mitigate the aftermath of a determined fraudster. Property management decision makers told us they need a fraud technology solution that is easy to use, enables advanced analytics, and integrates well with other systems. A solution like

– This would have a notable and positive impact on preventing bad reputation and debt, evictions, and vacancies. The director of real estate for a property management company said, “If you cannot point to a robust solution to prevent and identify fraud, you’re not going to have a good sales pitch to a client.”

Rental Fraud Is Prevalent And Rapidly Growing

Property managers responsible for managing thousands of units, particularly in urban corridors, have moved the rental application process online to cater to customer preferences for digital interactions. But as a consequence, they have opened the flood gates to savvy fraudsters who constantly evolve their tactics to stay one step ahead. Now rental management teams can’t verify application validity as easily, so they unknowingly accept fraudulent applicants. Even if 1% of applicants were fraudulent, the consequences would be severe. To avoid wasting thousands of dollars, damaging their reputation and losing customer trust, property managers have to think about how to avoid this situation.

This is the reality for many property management companies today. In conducting interviews and a survey with 153 property management decision makers we found that:

>Fraud is prevalent in the housing market. In the last two years alone, 97% have experienced fraud in the properties they manage. And more surprisingly, over 80% have experienced it up to 20 times.

>Digitizing experiences makes room for new types of fraud. Customers increasingly transact online, and property management companies are gratifying these needs by moving the application process online. Survey respondents reported that 59% of their rental applications are submitted online versus in person. And as online rental applications exceed in-person applications, so does applicant-based fraud. A regional VP at a property management company explained the situation:

“[Applicant-based fraud] is a big issue, particularly in urban locations.

We’re moving more into online fraud now, because we’re encouraging everyone to lease an apartment online, get their credit checks online, sign the lease online. We love being off paper, but sometimes we don’t meet applicants until they move in, so this increases the risk for fraud.”

› Fraud has lasting consequences. Most of the decision makers in our study believe that over half of bad renter outcomes (evictions, etc.) are tied to some sort of fraud. And property owners and management companies suffer serious ramifications as a result of this fraud: reputational damage, increased evictions, and more time spent on applications are the biggest implications.

A director of real estate told us:

“One of the biggest concerns is how [fraud] impacts our reputation. It can cost us business from our clients and it will often times cost us business from other clients who weren’t even impacted by the fraud. It can even cost us a management portfolio. We look at that as a smear against our reputation and our operational abilities. There is a very high cost and it’s not so much about the monetary implications as much as it’s about the reputation.”

A regional VP put the financial implications into perspective:

“On average, it takes 90 – 150 days to evict someone. That can be at times $16K in rent, plus an additional $1,500 in legal fees to evict the fraudster. So the financial loss is huge, especially compared with the much lower screening fees.”

Property Management Companies Are Not Armed To Fight Fraud

With breaches becoming regular news headlines, Forrester estimates that one recent breach alone caused a 5% to 10% increase in identity theft-related fraud in the United States.

Fraudsters are progressively getting smarter, making it difficult for companies to keep up with their advanced tactics. And to add insult to injury, we found that most property managers do not make a distinction between applicant screening and fraud mitigation. Understanding the differences between the screening process and true fraud mitigation would make property management professionals more: 1) effective in getting the right renters and 2) cost efficient by reducing involuntary turnover cost. To accomplish this, property managers need better tools to combat fraud.

CONFUSION EXISTS BETWEEN APPLICANT SCREENING AND FRAUD MITIGATION

The increase of online applications creates the need for technology solutions that identify, mitigate, and prevent fraud more accurately than human reviewers. One property manager reinforced this notion and told us:

“[A fraud technology solution] wasn’t as important five years ago, when we could speak with every applicant in person and verify information in person. Because we’ve expanded into the electronic world and are growing faster than we are prepared for, it’s becoming crucial to invest in a technology solution.”

It’s no surprise that fraud technology solutions are widely used — 63% of study respondents say they’ve already adopted it, and a quarter are planning on doing so within the next 24 months. But property managers in this study also report that they primarily rely on tools built in-house to provide fraud alerts; only 24% outsource a fraud detection technology solution. There’s a discrepancy here: firms are confusing the applicant screening process with fraud mitigation. Conducting background checks is not the same as applying fraud detection before move-in. And driver’s license checks and scans do not equate to fraud prevention, and, in many cases, on-site teams are not even seeing this in an online application transaction. True fraud detection takes into account:

› Identity verification (AKA proofing and vetting). Identity verification of applicants — which is also an integral part of up-front fraud detection — helps with avoiding synthetic identity fraud and identity theft.

› Potential past history of activity. Understanding and using past transactions and their disposition for risk scoring current and future transactions is a powerful tool in filtering out fraudulent activity.

› Consortium data. Using consortium data (data about other confirmed fraudulent activity) also greatly helps with detecting fraud and uncovering fraud rings. This is especially important on digital channels where fraud management solutions can automatically share and screen for fraudulent devices, locations, and fraudster behaviors. Conversely, fraud management tools can speed up new user enrollment/onboarding by fast tracking known good user behaviors, devices, and locations.

CURRENT FRAUD SOLUTIONS DON’T CUT IT

For most companies in this study fighting fraud is no easy task. In fact, 95% of companies surveyed experience difficulties identifying, mitigating, or preventing fraud. For over half of companies, excessive time spent on applications tops the list of issues, and both the inability to respond quickly to fraud and the lack of skilled resources follow closely. A director of real estate claimed:

“Our primary goal from an applicant base is finding the applicant that is willing, or most likely to serve the term of the lease, pay their rent on time, and not damage the community. But along the way, we find a lot of fraudsters trying to circumvent our system and get into the apartment. So, the resources we spend range from time spent by on-site managers and their staff in reviewing applications and getting additional verification if it is required. And if there is some fraudulent intent then there is additional verification needed. We have regional resources that help the on-site managers either approve or deny the applications and look for the fraud. We have the software costs that we incur. We perform regular audits of the application process, either performed by regional support staff or independent audits from clients or the company on a more randomized basis. But again, these are costly in regard to financial resources and take time away from other operational and fiduciary responsibilities.”

The reality is that current fraud solutions aren’t adequate because:

› They are reactive. Of all the possible points in the process to identify fraud, 73% experience it after the applicant moves in. And over 70% identified the fraud within the first six months after move-in, leading to forced turnover well before the typical end-of-lease cycle. This is an indication that current methods are not keeping up with fraudsters resulting in losses that could have been prevented. Being proactive in preventing fraud is more cost effective than not investing in the tools that companies need to combat it. As a regional VP put it:

“Most of the time, we unfortunately identify fraud after move-in. Which is terrible, and it puts us in a terrible position. If we can identify it in advance, that’s great.”

› They are manual. Thinking about the fraud that they have experienced in the past two years, most companies were made aware of the fraud from background checks or credit reports, not from an automated system — yet another indication that today’s fraud management methods aren’t adequate. A property manager told us:

“Outside of screening, the process is very manual. The on-site team scrutinizes the documents, which is hard to do given today’s advancements in fraud. And unfortunately, due to fair housing laws, there is only so much we can do in respect to scrutinizing things.”

A regional VP echoes the difficulty:

“A major challenge is that the salesperson is leading the application review process. In an ideal world, they’re taking time on this, but it can be time consuming, so they often gloss over this part. An electronic verification process would be something I’d be highly interested in.”

› They lack advanced capabilities. When interviewing property management professionals, we found that some consider a scan of a driver’s license as a fraud check. While this is a step in the right direction, it does not cover the full scope of fraud that is prevalent today. Additionally, existing solutions don’t compare an applicant’s risk to established indicators, nor do they seamlessly add identity verification into their brand. The lack of these advanced capabilities deters property management companies from preventing and mitigating fraud.

Key Recommendations

With fraud proliferating in the rental industry, property owners and managers can only keep up by radically transforming their approach to preventing and managing rental fraud. Forrester recommends a combination of the following key elements to build your rental fraud management strategy:

Build a robust fraud management strategy to quickly identify fraud. Look at fraud management when a rental application is submitted allowing the operator to be proactive and ahead of the game. Waiting to do this after the screening or worse, finding out after the renter moves in, is proven to be detrimental to property operation.

Integrate fraud management with screening. Using disparate background checks/screening solutions separately from fraud management and risk scoring tools is inadequate. Unify the screening and fraud management processes and look at them holistically through a single pane of glass, i.e., policy management, risk scoring, auditing, etc.

Do not rely on your staff alone to detect and update new fraud patterns. Fraud patterns and techniques change quickly and frequently. Use a versatile screening solution that is integrated with a fraud management functionality and is updated periodically and automatically to detect new emerging, complex types of rental fraud.

ABOUT FORRESTER CONSULTING

Forrester Consulting provides independent and objective research-based consulting to help leaders succeed in their organizations. Ranging in scope from a short strategy session to custom projects, Forrester’s Consulting services connect you directly with research analysts who apply expert insight to your specific business challenges. For more information, visit forrester.com/consulting.