Opportunity to Exit

by Brian Gordon

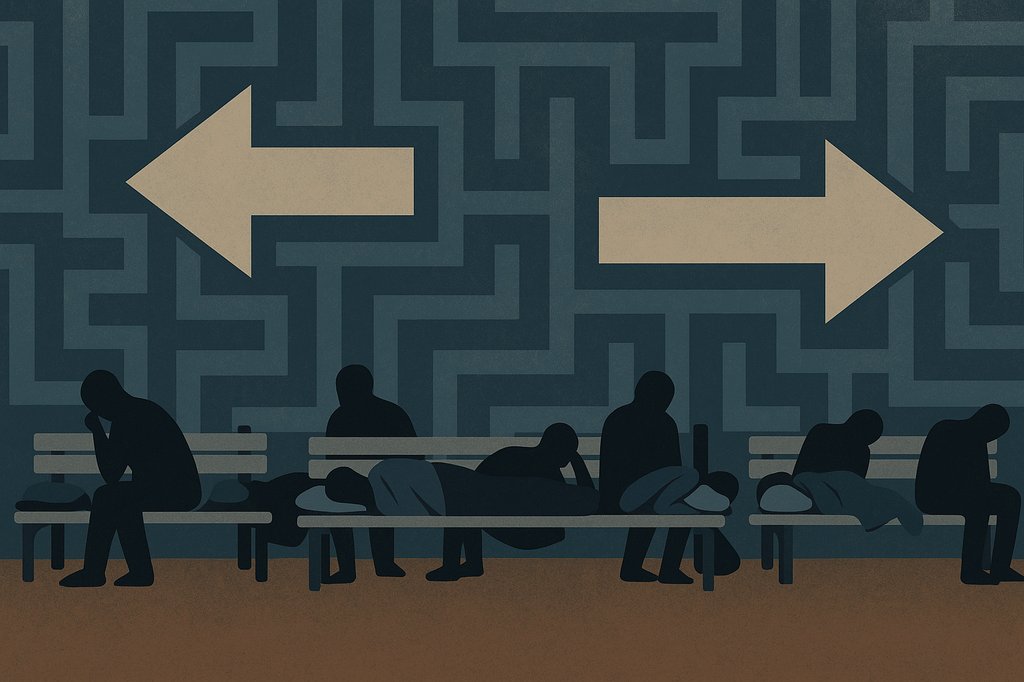

Every investment needs an exit strategy. Without it, you’ve failed to map out a plan and like the old saying goes: “When you fail to plan, you plan to fail”. For many investors, the exit may be transferring to your children, charitable donation or simply securing the passive income to supplement a comfortable retirement. For many new investors in the Southern California multifamily market, the opportunity to exit couldn’t come fast enough.

Every investment needs an exit strategy. Without it, you’ve failed to map out a plan and like the old saying goes: “When you fail to plan, you plan to fail”. For many investors, the exit may be transferring to your children, charitable donation or simply securing the passive income to supplement a comfortable retirement. For many new investors in the Southern California multifamily market, the opportunity to exit couldn’t come fast enough.

We all recall the rollercoaster days of 2005 – 2007 when we saw trends of rising rents, skyrocketing values and the bliss of never hearing the words “great recession.” It seemed like anyone holding a grant deed those days completed a 1031 exchange and rolled sizable equity into their next real estate investment. This was the case for many first time investors purchasing their first apartment building. Many were lured with attractive purchase return figures and sought the security of multiple tenants and eagerly jumped into the apartment building realm.

Even as the rental market softened in 2008, the multifamily market in Los Angeles felt somewhat unscathed. The apartment values dipped, but this seemed overshadowed by the foreclosure crisis for homes and condos. A few dollars less in rent seemed bearable when neighboring homes were valued ½ of the peak price.

Investors that were new to the market have encountered a tough time in apartment building ownership and management. Our whole industry shifted and is once again scrambling to adapt to the change. This time, the challenges are harder and the risks seem greater. In Southern California, lawsuits are plaguing our industry. There is a whole industry of predatory attorneys focused on suing property owners. No longer needing actual damages to file a lawsuit, landlords have become the latest target. Everything you have struggled to gain feels like it could be taken away in moments by a frivolous lawsuit. Even if you are certain the law is on your side, proving you’re right will be a costly endeavor. Tenants know this fear and use this as ammunition to manipulate everything from rental concessions to their desired improvements at the property.

Overregulation of city inspections, county inspections and special task forces geared at protecting tenant’s rights has turned managing your investment property into an expertise. As the landlord, you’re cited because of the resident’s lack of housecleaning, infestation of bedbugs and even the missing window screen you may have replaced the day before the inspection. To make matters worse, there is zero check and balance within the agencies so expect differing results from LAHD to the Environmental Health inspections. If you property falls within Los Angeles Rent Control area, expect the inspections to happen about twice or three times as much as non-rent control areas.

With a simple Google search of “fight your landlord and win” you’ll lose some needed sleep tonight. The internet has given residents a tactical edge to manipulate any given situation. A solid Lease Agreement with clearly spelled out clauses is no longer a firm basis for protection. Landlords face everything from discrimination cases for failing to allow companion pets to substance abuse problems loosely classified as disabilities requiring Lessors to provide “reasonable accommodations” to tenants. The industry is growing more complex and first time owners are weighing the returns after exhausting all the efforts.

In addition, landlords must recalculate a realistic vacancy factor along with loss of rents for all new evictions. Unlawful detainers are now setting unprecedented time records for both uncontested and contested evictions. In greater Los Angeles, the eviction courthouses merged and made significant staff layoffs. This restructuring applied heavy breaks to the wheels of justice. Compounding problems, a significant number of tenants now request trials by jury for evictions. Investors stand to lose thousands just in attorney fees not to mention loss of rent and other damages. The process quickly turns a standard eviction into a multi-thousand dollar legal gamble with no guaranteed win. This legal extortion will quickly drive the most seasoned investor to the brink of liquidating their property.

Investors are exhausted with management, fear further legal attacks and tired of fighting the government bureaucracy of inspection agencies. Investors that purchased during the 2005 – 2007 peak are now seeing a rebound in prices close to their original purchase values. This gives these investors the prime opportunity to unload their apartment building and cash in on the hot market. The Los Angeles multifamily sales market has been coined a mini-bubble the last few quarters. This is no surprise for those of us watching cap rates dwindle and prices steadily rise. Echoes of the last housing bubble are all the buzz. Many investors are ceasing this opportunity to exit the apartment industry in general or exchange their multifamily property to less management intensive investments. This Seller’s market may be your golden opportunity to revisit your exit plan. Pencil your numbers, gauge your investment’s performance and weigh your options as this may be the prime opportunity to exchange or sell your building.

Thanks for reading and happy investing – from The Apartment Experts

Brian Gordon | Lotus Property Services, Inc.

Brian Gordon & Vince Medina have developed a successful system of property management that creates value add opportunities for underdeveloped markets. Through their exclusive Development & Management Program, Brian & Vince have created a vast network of thousands of local, national and foreign investors.