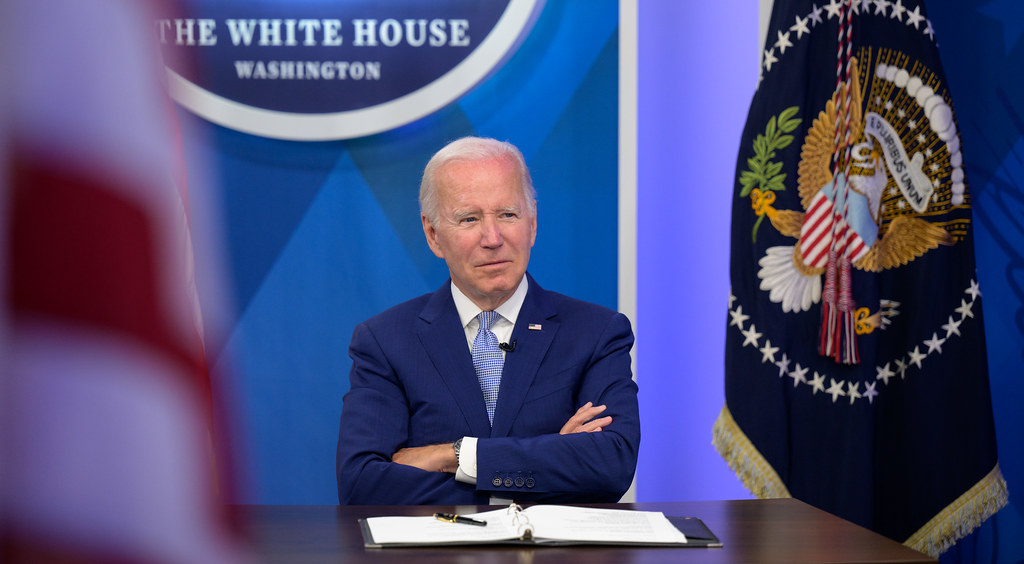

President Biden Has Proposed Tax Increases. Here Are 6 Of Them

President Joe Biden is thinking big when it comes to his budget and the taxes that are needed to pay for it. The president’s FY 2025 budget is a whopper at $7.3 trillion, and the budget floats some serious tax increases, too. As you might predict, much of the focus is on getting higher income taxpayers to pay more.

Higher Rates

Currently, the top federal rate on ordinary income is 37%. Biden has proposed increasing it to 39.6%, which was the top rate back in 2017. Starting in 2018, President Donald Trump signed into law the Tax Cuts and Jobs Act that made many cuts, including the 2.6% cut to the top ordinary income tax rate. Notably, though, the new 39.6% rate is only supposed to apply to taxpayers making $400,000 or more.

Capital Gain Tax Increase

If you sell your stock, property or crypto and you’ve held it for more than one year, you get a classic tax break. Long-term capital gains are taxed at lower rates than ordinary income. But how much lower depends on your income. If your taxable income is $47,025 or less, you pay zero tax on your long-term capital gain. If your taxable income is from $47,026 to $518,900, you’ll pay 15% on your long-term capital gain.

PROMOTED

If your taxable income is more than $518,900, you pay 20% on your long-term capital gain. Under current law, even if you have millions in long term gains, your top capital gains tax is 20%. But before we discuss Biden’s proposal, it’s important to note that many long-term capital gains are also subject to the net investment income tax, sometimes called the Obamacare tax.

That is another 3.8%, bringing the typical top tax rate on long-term capital gains to 23.8%. This 3.8% net investment income tax applies if you have modified adjusted gross income above $250,000 if you are married and filing taxes jointly. If you are single, the threshold is $200,000.

How would the capital gains tax change under Biden’s FY 2025 budget proposal? For high income taxpayers, the long-term capital gains tax could nearly double to 39.6%. That proposed capital gains rate increase would apply to investors who make at least $1 million a year. In fact, it is possible to go even higher, as high as 44.6%. Portions of the General Explanations of the Administration’s FY 2025 Revenue Proposals note that for some taxpayers, if you add several proposals together, they could increase the top marginal rate on long-term capital gains and qualified dividends to 44.6%. It seems unlikely that this major capital gains tax change will be enacted, but time will tell.

Medicare Tax

President Biden is proposing a tax increase for people making more than $400,000 a year to help finance Medicare. The increase would hike the Medicare tax rate from 3.8% to 5%.

1031 Exchanges

Section 1031 is one of the few sections of the tax code everyone seems to know. It is even routinely used as a verb. Under 1031, if you exchange real estate for like-kind real estate, the gain is postponed until you sell your replacement property. Properties are of like-kind if they are of the same nature of character, whether they’re improved or unimproved. For example, an apartment building would generally be like-kind to another apartment building. Starting in 2018, swaps of BitcoinBitcoin 0.0% for EthereumEthereum 0.0%, exchanges of private aircraft, paintings, or coin collections don’t qualify. Only real estate qualifies, and it must be of like-kind. It has to be business or investment property, not your personal residence.

Still, improved real estate can be exchanged for unimproved real estate. And city real estate can be exchanged for a ranch or farm. The real estate industry has counted on this provision for generations, but President Biden’s FY 2025 budget would repeal this code section. The White House has said that it “amounts to an indefinite interest-free loan from the government.”

No More Carried Interest Loophole

Some fund managers are able to treat certain types of carried interests as a long-term capital gain, even though they receive the interest as part of their pay. This provision of the law has long been criticized, and the Biden budget proposal would treat these interests as ordinary income for federal income tax purposes.

Billionaire Tax

President Biden also wants to impose a minimum tax on billionaires. The provision is controversial in part because it is a type of wealth tax rather than a traditional income tax. Despite the billionaire label on the proposal, this new tax would also apply to people who are wealthy but a long way from being a billionaire. If passed, the billionaire tax would be a minimum of 25% for households with net worth exceeding $100 million.

Written by Robert W. Wood

Robert Wood handles tax matters across the U.S. and abroad (www.WoodLLP.com), addressing tax problems, tax disputes, writing tax opinions, tax advice on legal settlements, transactions, crypto, and many other matters.

Wood LLP is a nationally recognized tax law firm representing clients worldwide in tax matters. We give tax advice and handle tax controversies about lawsuit settlements, transactions, cryptocurrency, tax residency, litigation finance, and more. We write formal tax opinions and handle audits, appeals and tax litigation.

Please email Wood@WoodLLP.com for more information.