Who Will Be the Next Generation of Multifamily Investors?

As housing affordability challenges continue to intensify, a new generation of would-be homeowners is finding it harder than ever to purchase their first property. Faced with soaring home prices and stagnant wages, many millennials and Gen Z individuals are remaining renters for much longer than previous generations. This growing segment of the population, unable to break into homeownership, is driving increasing demand for rental housing.

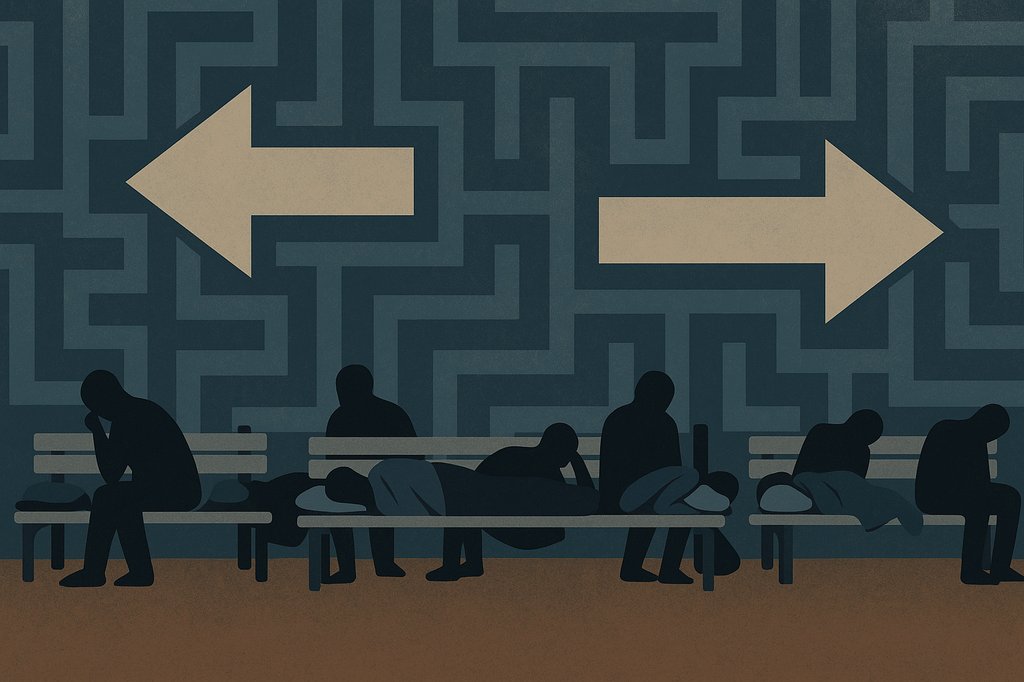

With so many people locked into renting, it seems logical that only a small percentage of this generation might eventually save enough to invest in real estate. However, the reality is far more complex. While multifamily properties once offered individuals a path to building wealth, today’s climate has left many prospective investors hesitant. The primary concern for many is: “What will I do if I get a bad tenant and can’t evict them?”

This fear is not unfounded. With increasingly stringent tenant protections and rent control measures, housing providers face growing challenges when dealing with difficult tenants. Eviction processes have become longer and more burdensome, leaving many would-be investors worried about the financial risks. For these individuals, the uncertainty and potential costs of being unable to evict a problem tenant make real estate investment feel more like a gamble than an opportunity.

So, who will be the next generation of multifamily investors? If young people are already struggling to buy their first homes and have become disillusioned with the idea of becoming landlords, how can they be expected to invest in rental properties?

The answer may be that they won’t. The days of the “mom and pop” investor, who purchased rental properties as a means of securing their retirement, could be disappearing. As government intervention in housing markets grows and tenants’ rights continue to expand, the investment landscape is becoming more challenging. Smaller investors are either being priced out or turned off by the regulatory hurdles and the risks associated with tenant issues.

In this climate, large corporations may be the only players with the appetite and resources to take on multifamily investments. Big institutional owners have the financial strength to weather the risks of problematic tenants, eviction delays, and costly legal battles. Unlike individual investors, they can absorb these costs while still maintaining profitability.

But there’s another possibility: government intervention in the form of taking over multifamily housing. In some places, local governments have broached the idea of purchasing multifamily buildings to offer affordable housing directly. While this might sound like a solution to some, the downside is that government-run housing often struggles with inefficiency and poor management.

As multifamily housing becomes more regulated, we could be heading toward an era where the bulk of rental properties are owned either by large corporate landlords or by the government itself, leaving little room for smaller, individual investors. This shift could have far-reaching consequences, including less diversity in ownership, fewer opportunities for individuals to build wealth through real estate, and potentially lower-quality housing options for tenants.

Having spent over two decades investing in rental housing and passionately advocating for the industry, helping countless everyday Americans achieve the American Dream, it deeply concerns me to see the troubling direction the industry is heading.

Government intervention and expanding tenant rights have created an environment where only large corporations or the government itself may have the resources to invest in multifamily housing. The result? The American Dream of owning investment property is slowly slipping away, and with it, a critical path to financial independence for many families. This is not just an issue for investors—it’s an issue for anyone who believes in the power of real estate to transform lives and build long-term financial security.

Written by Mercedes Shaffer, Realtor

Mercedes Shaffer is a multifamily real estate agent with REAL Broker, and If you have questions about buying, selling or doing a 1031 exchange, her team serves LA and Orange County and can be reached at 714.330.9999, InvestingInTheOC@gmail.com, or you can visit their website at InvestingInTheOC.com DRE 02114448