Rental Standards To Use in This Tough Economy

By Robert A. Machado

Last month I discussed five important standards to use to qualify your tenants. These standards work just fine the majority of the time and using them will be your first and best step in protecting your property and your cash flow.

- Household income must gross three times the monthly rent.

- Credit must be 80% perfect with at least two lines of credit reported.

- Rental or ownership must be positive the past 2 years.

- No more than two persons per bedroom plus one additional for the property.

- No more than one pet and no dangerous breeds (breeds could be listed).

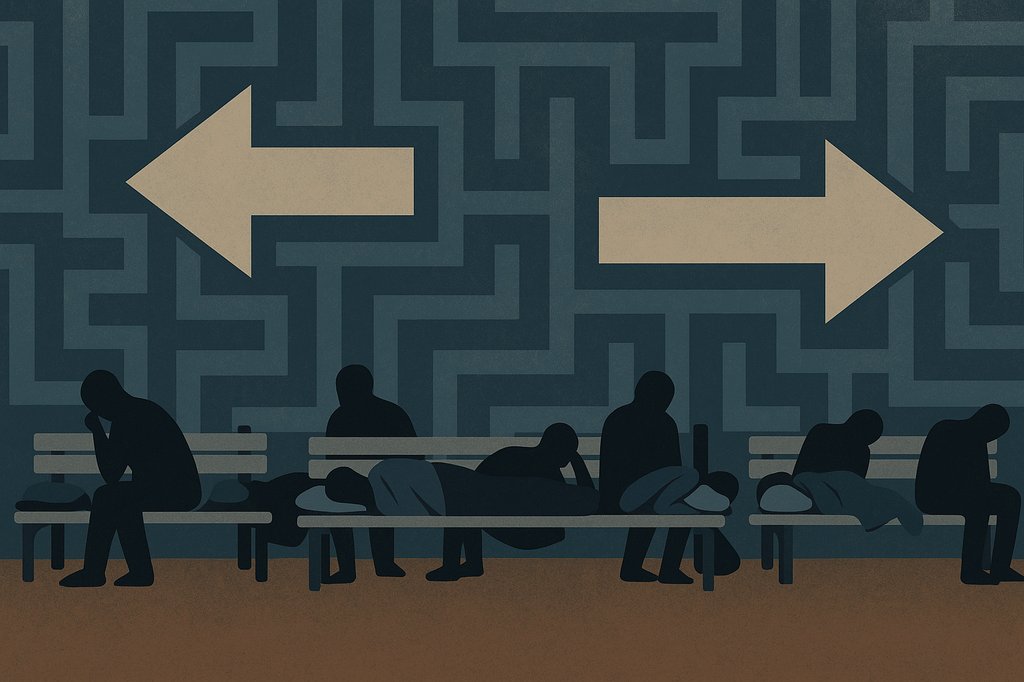

Two of the standards, credit and rental or ownership references, have taken a beating in last couple of years. This is not true for every applicant that you will come across, but it affects enough of them that a deeper analysis could well be worth your while.

Over the course of the past four years the U.S. economy has gone from boom to bust. California in particular has suffered greatly, and the Sacramento Region has been one of the leaders of the downturn nationally in real estate prices and unemployment. I have personally seen a house that was purchased for $260,000.00 in 2005 sell for as little as $63,000.00 in 2008. A 76% decrease in price! Many of those loans made in the boom times are being foreclosed upon by their lenders. The owners and investors that took out the loans stop making payments for a variety of reasons. Some can no longer afford to make the payments due to a job loss. Others have seen payments go up due to resets on the interest or terms. Many of those unfortunate boom purchasers, owner occupiers and investors owe a lot more on their property than it is worth.

For every defaulted loan on an owner occupied property, there results a need for that former owner to rent a property. Like my dad used to say, “you have to be somewhere”. Landlords are seeing a flood of these applicants. The question is, are they a good risk?

In my view, turning down all these applicants is a mistake. For one, there are too many of them. Second, many got caught in the crossfire of this economic downturn and are not necessarily a bad risk. Finally, there is a way to sort out who is high risk and who posses little or no risk.

When someone goes into default on their loan, they have some decisions to make. Namely, what bills to pay and keep current and what to not pay. If the decision is to stop paying all bills it becomes impossible to sort out. But, if the property owner gave up on their mortgage only the picture becomes a bit more clear. On their credit report it will show only the mortgage in default including the amount of the loan. With this information it can be determined that the person was truly under water on their loan, but kept the rest of their credit obligations intact. That is someone worth considering as your tenant.

Others will stop paying all of their bills. Basically they panic or worse, decide to take advantage of the situation. My conclusion on those applicants is to not accept them as my tenants.

In conclusion, the economic downturn has created a situation where rental applications are flooding the market with less than perfect credit reports. The prudent landlord should determine what each applicants situation is and have a plan to sort them out between the ones that are a good risk and those that are not.

Bob Machado is President and owner of HomePointe and graduated from UC Berkeley “With Distinction” (1977) and has a degree in Economics. He holds the Certified Property Manager (CPM, 1992) and Master Property Manager (MPM, 1995) designations. Bob has been managing residential and commercial property in the Sacramento area since 1980 and is both an owner/investor and fee manager. Bob holds a California Brokers License.

Bob was born and raised in Sacramento and has lived in Sacramento most of his life. He attended and graduated from Sacramento City College (1974) earning an Associates Degree in Accounting. Bob is a founding member of the local chapter of the National Association of Residential Property Managers (NARPM) and was its first president (1992). In addition to his local leadership, Bob is a past National President of NARPM (1996-97) and served on the national board from 1992-1998. Bob is a nationally qualified and recognized speaker for the association and teaches various property management topics and has authored several property management courses.