RISK MANAGEMENT 101, Part 2

By Eric D. Jarvis, Esq. | Founder of ReassureRent

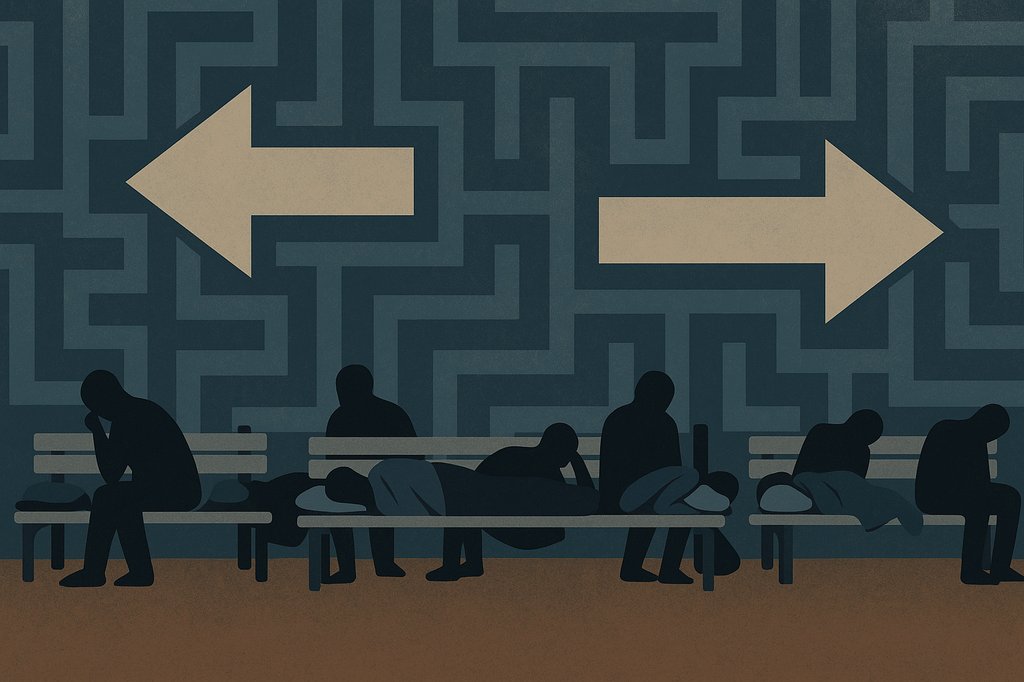

It’s every landlord’s nightmare: A tenant who can’t, or won’t, pay the rent. You’ve invested in your property. You are obligate to continue to pay taxes, insurance, a mortgage, and maintenance, and you depend on that income. You provided a home for your tenant and you have a right to expect that tenant to keep their end of the deal. Now you’re involved in a time consuming and emotionally draining eviction process. In the best situations, you will pay some legal fees and lose some rent. In the very worst situations, you could spend thousands in legal fees and lose half a year of rent before you get your property back.

It’s clear that the risk of a tenant who fails to pay rent is a risk that needs to be managed. In business, risks are generally managed in ways that fall into one of four categories: 1. Risk Avoidance, 2. Risk Mitigation, 3. Risk Retention, and 4. Risk Transfer. Some of these risk management strategies will not be very useful for landlords, while others can bring tremendous advantages in managing the risk of the non-paying tenant. In part one of this article last month, we discussed the first two risk management strategies, Risk Avoidance and Risk Mitigation. In this part two of this article, we will look at Risk Retention and Risk Transfer, and come to a conclusion about which strategies are best when a tenant can’t, or won’t, pay the rent.

3. Risk Retention – Accept it

The opposite of risk avoidance, risk retention is the strategy that says, “OK, I’ll take that risk.” Accepting risk occurs when one looks at and recognizes the risk, but then decides it is not so bad that it is necessary to avoid it, or to spend money on managing it. For example, there is always a risk that a water pipe may leak in your unit. However, you don’t avoid the risk by shutting of the water supply, and you don’t mitigate the risk by hiring someone to constantly watch the pipes. Most people just acknowledge that it is a potential risk, and know that they will simply deal with it if and when it happens.

Risk retention is relatively inexpensive. There is no up-front cost to accepting the risk, and no cost of systems or controls. However, risk retention is best for minor risks. Those risks that are real but not so potentially damaging that they would cause a significant negative impact in terms of cost or effort. The nonpayment of rent by a tenant is, by contrast, central to the business of being a landlord, simply accepting and retaining the risk of a defaulting tenant would be very damaging and have a significant negative impact. Risk retention is therefore not a recommended strategy to manage this risk.

4. Risk Transfer – Transfer it

Risk transfer is a risk management strategy that involves shifting the risk away from yourself, to someone else. This is usually done through an insurance policy, which is a contract where the insurance company agrees to accept a risk in exchange for the payment of money. The money paid for this transfer of risk is called premium. When a property owner purchases fire insurance for his building, he pays a premium to the insurance company, who in turn assumes the risk of that building burning down – if it does burn down, the insurance company will reimburse the owner for the loss.

Risk transfer is ideal for those risks that can be very damaging have a significant financial impact, even if the likelihood of it happening is quite small. For example, the U.S. Fire Administration (part of FEMA), estimates that there were 380,900 residential fires in 2015. The U.S. Census reports that there were 124,590,000 households in 2015. The likelihood of a house fire in 2015 was therefore just 0.31% in 2015. Yet, because the impact of a house fire is so devastating, almost every one of those households bought fire insurance!

The Orange County Register reports that 499,010 unlawful detainer cases were filed over the last three years in California. The average time to get a tenant out of a unit is 2 months and can be as long as 6 months. For many landlords, the lost rents, legal fees, and other expenses can be devastating. If the landlord could transfer that risk to an insurance company, who would pay the legal expenses of the eviction, and reimburse the landlord for the lost rent, the landlord would have the best outcome out of all of these risk management strategies. Risk transfer is therefore the best strategy for managing the risk of the tenant who can’t, or won’t, pay the rent. ReassureRent tenant default insurance is an insurance policy that is exactly designed for this risk.

Conclusion

We have reviewed the four primary categories of risk management strategies used by professional risk managers. We’ve applied these strategies to the risks of property owners, in particular to the risk of the non-paying tenant. Risk avoidance and risk acceptance seem the least desirable strategies to employ. Risk mitigation by credit reports and security deposits is the current strategy of the industry, but cannot protect against future changes in economic circumstances. Only risk transfer, using an insurance policy like ReassureRent, which covers the legal expenses of eviction and which actually reimburses lost rental income, provides the most complete protection against the tenant who can’t, or won’t, pay the rent.

Eric D. Jarvis is the founder of ReassureRent, the exclusive provider of tenant default insurance. Eric is also an attorney, who, prior to his 20 years as an insurance and risk management professional, practiced landlord/tenant law in Southern California. ReassureRent can be reached at (833) 5TENANT (833-583-6268), and at www.reassurerent.com/aptnews.