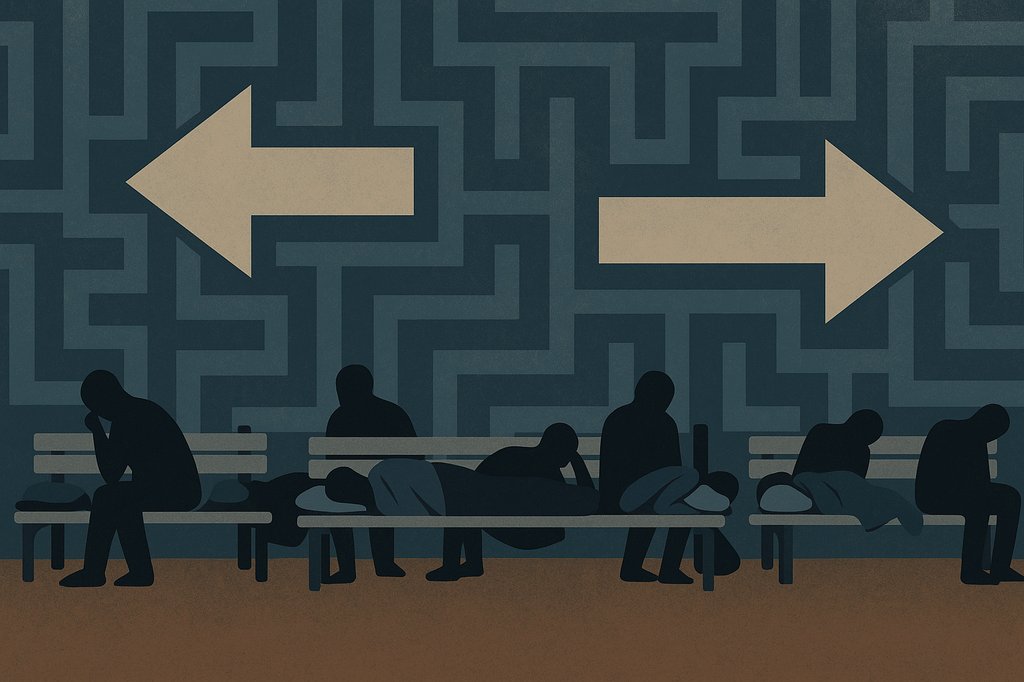

Should landlords raise the rent just because they can?

This is a provocative question that depends on a host of factors. Assuming a rent increase is permissible, is it advantageous to raise rents now? That’s what we attempt to answer here.

We were asked in this town hall webinar to make a prediction on how the outcome of the Presidential election would impact the rental housing community and we dodged the question a bit on a day when we awoke to an orange tint in the sky. Our response was that as the future got stranger and stranger, we were living day to day with the hope that we all would return to some semblance of normalcy soon, but had no understanding of what would occur next.

Fast forward to today and we finally have a sense of clarity

After lawmakers and the Governor got together to finalize legislation to deal with the economic fallout of the pandemic and distribute billions of dollars to landlords to recoup rent debt, we hope that Assembly Bill 832 is the last extension of tenant protections and is the final chapter in what has been a dizzying and confusing regulatory regime that seemed to change on a weekly and monthly basis.

Have we reached a turning point with rents?

There have been some conflicting numbers floating around as to what the bill of health is for California and the Bay Area.

We were taken aback by this CNBC article that reports that San Francisco saw a 79% increase in prospective renters compared with 2020. We can confirm that there has been an uptick in showings, but when we look at the composition of apartment shoppers, it is largely existing Bay Area renters looking to take advantage of lower rents to even upgrade to nicer digs.

If a tenant has been paying $2,500 for cramped living space and can get a better abode for a comparable rent, why wouldn’t they seize the opportunity? The spike in rental applications is not because of an influx of new faces coming to the Bay Area.

What’s the value of a good tenant?

During the pandemic, the value of a desirable tenant has gone up. If a tenant has faithfully paid rent on time, is a model resident and does not create nuisances for neighboring tenants, and is anchored to their current location, it may not make sense to raise the rent and run the risk of the ideal tenant going elsewhere. We know that a good tenant is worth their weight in gold, and it might take a long time to fill a vacancy at a higher rent amount.

Throughout the long, dark winter of COVID, we have told clients that in some circumstances, it might make sense to lower the rent in order to retain a good tenant. We’ve been careful to explain that rent debt should generally be deferred and not waived, but there are exceptions to this rule. If the landlord likes the tenant, a steady stream of rental income is flowing in, the tenant is not creating any damage to the premises and wants to stay put, it could potentially be prudent to lower the rent if the tenant is struggling and is likely to get back on his or her feet.

What will the market look like in the near to intermediate future?

Facing a recall election, Governor Newsom has coined the phrase, California is “roaring back.” We feel that this statement is a bit exaggerated and the economy is instead slogging back to life in a painfully slow process.

There is a mixed bag of economic news, but with reports of California unemployment claims soaring to the highest total in three months among other downers, the rental housing community should not be overexuberant by believing there will be an easy bounce back from COVID-related economic setbacks. Our community should not cling to the false hope that rents will be anywhere near pre-pandemic levels anytime soon.

Has the government artificially propped up the financial health of renters?

Since the outset of the pandemic, landlords have been asked to bear the brunt of the pandemic. The public policy of stabilizing housing and averting displacement has left the needs of cash-strapped landlords to the wayside. One thing the government did well, however, was pumping a lot of liquidity into the economy.

Lawmakers were very generous with doling out funds and inventive with new programs such as unemployment benefits tailored for the “gig” community and independent contractors like Uber and Lyft drivers, hairdressers, consultants, and the like.

The concerning question we have now is what will happen when the federal safety net is scheduled to be pulled back to normal on Labor Day and some people will lose their benefits altogether.

The free-money phenomenon has put people deeper into debt

An enormous amount of debt has been accrued during the pandemic and these IOUs will become due. According to this article, mass-forbearance has swept credit problems under the rug and now there is a big mess under that rug.

The era when consumers could stop making payments without having their credit dinged or experiencing other consequences will soon end.

We say all of this to say what?

Some economic indicators, coupled with a skeletal tech workforce and remote learning and migration to the suburbs, suggest that Bay Area rents need time to breathe and reset. We do not expect rents to surge in 2021. Assuming the delta COVID variant does not wreak havoc, there should be improvements in 2022, but realistically, our community should not harbor any illusions that rents will return to the levels we’ve been accustomed to before 2020.

Of course, there are exceptions to every rule and our strong preference is to evaluate the unique characteristics of a property. While landlords and property managers can easily point and click to get a feeler for comparable rents, not all market comps are created equal. We use a variety of sources to right-size the rent amount and take into account many intangibles – technology cannot be used as a crutch.

A bird in the hand is worth two in the bush, we’ve maintained throughout the long, dark winter of COVID

It’s been reported that “asking rents” are heading higher, but asking rent is just that – asking. Landlords know their numbers and should engage in a cost/benefit analysis to weigh the pros and cons of raising rents in a vacant unit.

If the rent is set too high, the unit can languish for months with no rental income. This can be especially painful for owners who have been hemorrhaging money throughout the pandemic. By finding the just-right rent amount to charge, landlords can begin to get cash flowing again and that should be the paramount goal during very difficult times.

We want to avoid situations where prospective renters would ink a lease if the rent was a few hundred dollars lower but instead, the unit is overpriced and it results in many months of no rent. If you do the math, it could take a very long time to recoup the lack of revenue by letting the unit sit on the market for an extended period.

Parting thoughts

This has been a little bit of our soliloquy on where rent prices might be headed and how to think smartly and strategically about optimizing the income of investment properties. Bornstein Law cannot predict the future, nor can anyone, but we can do the next best thing by providing sound counsel in managing landlord-tenant relationships and helping you power through your real estate challenges.