Student Housing Sector Continues to Outperform

The past two quarters were monumental for student housing. In the first quarter of 2016, a record $2.6 billion in capital poured into the sector, marking the largest single-quarter investment since 2006. In total, the sales volume made for 66.2 percent in year-over-year growth for this property type, according to Lucy Fletcher, a managing director and international capital expert at commercial real estate services firm JLL.

“We are seeing more direct deals by foreign investors this year,” she says, with about one half of the volume in this quarter coming from offshore investors. That $1.4 billion in foreign inflow came primarily from a joint venture deal between Scion, Canada Pension Plan Investment Board and GIC, which formed Scion Student Communities and acquired University House Communities Group’s portfolio.

“Why is global investment increasing? Resiliency of income,” Fletcher says.

This quarter and last quarter, we are seeing “increasing international investment through income funds and sovereign funds,” says Tom Errath, senior vice president of research for Harrison Street Real Estate Capital, the largest private equity firm focused on real estate investments in student housing, managing approximately $10.6 billion in AUM. For universities seeking to build on-campus housing, Errath says Harrison Street is one of a number of firms and investors who are starting to enter into 50-to 75-year ground lease agreements with universities.

Land lease agreements are becoming more popular for campuses that need repositioning or that have been vacant, sources say.

So far this year, the student housing sector is seeing cap rates that are consistently just north of 6.0 percent.

When investors consider student housing, the most crucial elements are real enrollment numbers, location, sponsor strength and site operation experience.

“Investors are buying into really well-managed platforms. There is large pent-up demand across the entire sector of core products,” says Scott Streiff, executive vice president with JLL. He describes the core class-A product as having enrollment of 30,000 students plus. “We are seeing investors chasing core products that deliver attractive cap rates with projected student enrollment increases.”

Right now investors are seeing those types of properties trade at approximately 5.0 percent cap rates. “Larger campuses historically carry lower cap rates,” Streiff says.

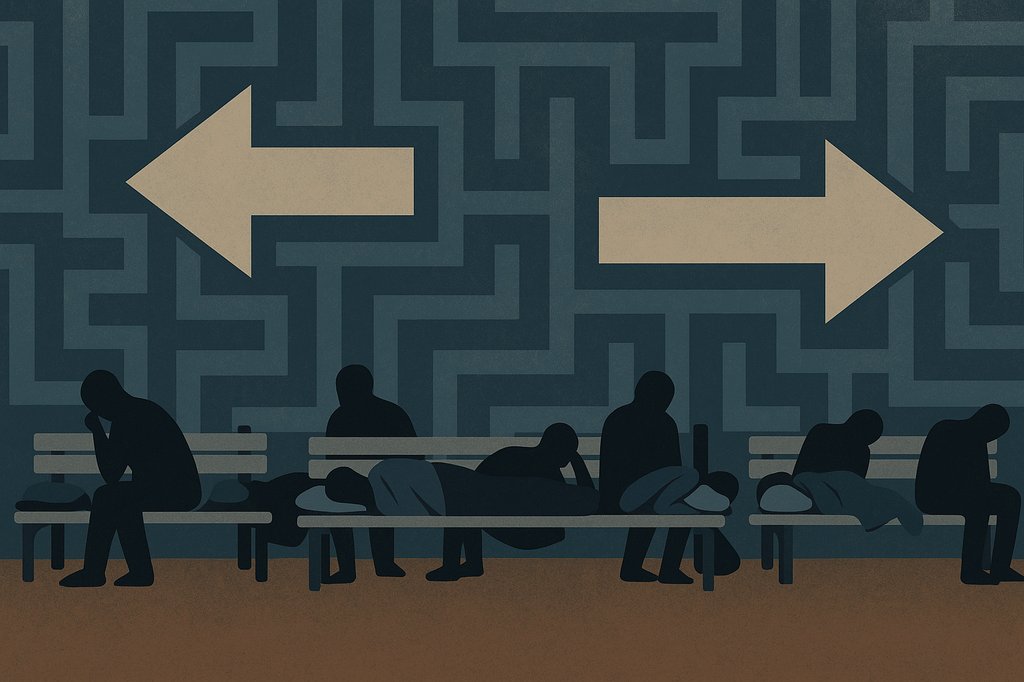

Never quite even

“I don’t know if there will ever be a point of supply and demand meeting in this sector, says Jaclyn Fitts, national director of student housing at real estate services firm CBRE. Student housing tends to be recession-proof, since when times get tough, many people opt to return to school. Add to the equation the national trend of continually increasing enrollment rates for higher education. The year 2014-2015 was the biggest on record in this sector for new beds added, with approximately 60,000 new beds, according to CBRE data. The firm expects another 45,000 student housing beds added in 2016-2017.

“There will continue to be investment opportunities in 2017 and 2018,” says Fitts. “We will continue to see new development in 2017. Additionally, purpose-built student housing properties completed in the 2000s are primed for repositioning, so we will continue to see opportunity there in rehabbing first-generation purpose-built [properties] and raising rents.”

Although supply is being added yearly, there is still 96 percent occupancy nationally for the 2015-2016 academic school year, Errath says. There were some specific markets, however, that saw overdevelopment this year. One example is Texas A&M, a market that needs to absorb 7,500 more beds in the next three years, according to Fitts.

Student housing spin-offs

Post-graduation, many young adults find themselves facing an expensive housing market and a very tight apartment rental market. Those who are pursuing post-graduate degrees or already working at the university may not have the funds or credit history to qualify for traditional housing options.

One developer, Post Brothers, has sought to answer the needs of this market and is doing so by delving into a sub-sector called post-graduate housing. Post Brothers builds and invests in university housing-oriented cities that have college economies. College economies generally have large research budgets, NIH grants and major hospitals that act as employers for post-graduate students.

Post Brothers recently acquired Garden Court Plaza, a 13-story, 146-unit apartment building at 4701 Pine Street in Philadelphia for repositioning as part of its development strategy in University City. The developer has earmarked $250 million for continued development in that city in the next few years.

“We see it as better than student housing, because it is targeted to young professionals and graduate and medical students. They may not want to pay for class-A new construction and our properties offer a value proposition that doesn’t compromise quality,” says Matt Pestronk, CEO of Post Brothers. “ We are not seeing a lot of investor resistance to the concept.”

Source: nreionline.com