Why California’s New Airbnb Tax Is a Wake-Up Call for Apartment Owners

The numbers no longer pencil out like they used to. Once seen as a golden opportunity for passive income, short-term rental properties are now facing mounting pressure from every direction. The most recent hit? California Senate Bill 584 (SB 584), the Laborforce Housing Financing Act, which imposes a new 15% state tax on short-term rentals went into effect on January 1, 2025.

This tax applies to any stay of 30 days or less in a non-hotel setting, such as a home, condo, or room rented via short-term platforms. The revenue will be used to fund affordable housing for low- and middle-income workers — a noble cause, perhaps, but one that comes at a steep cost to private property owners.

This new tax is on top of existing local transient occupancy taxes (TOT) and fees — many of which are already between 10% and 15%. For example, in Huntington Beach, the math is simple but sobering:

TOT: 10%

Tourism Business Improvement District (TBID) Assessment: 4%

Combined Local Taxes: 14%

Add New State Tax (2025): 15%

Total Tax Burden on Each Stay: 29%

Now factor in rising insurance premiums, surging utility costs, cleaning, maintenance and property management fees–and platform commissions (Airbnb and Vrbo charge hosts 14–20%), and it’s easy to see why so many short-term rental owners are questioning whether it’s worth it anymore.

What’s Happening in the Market

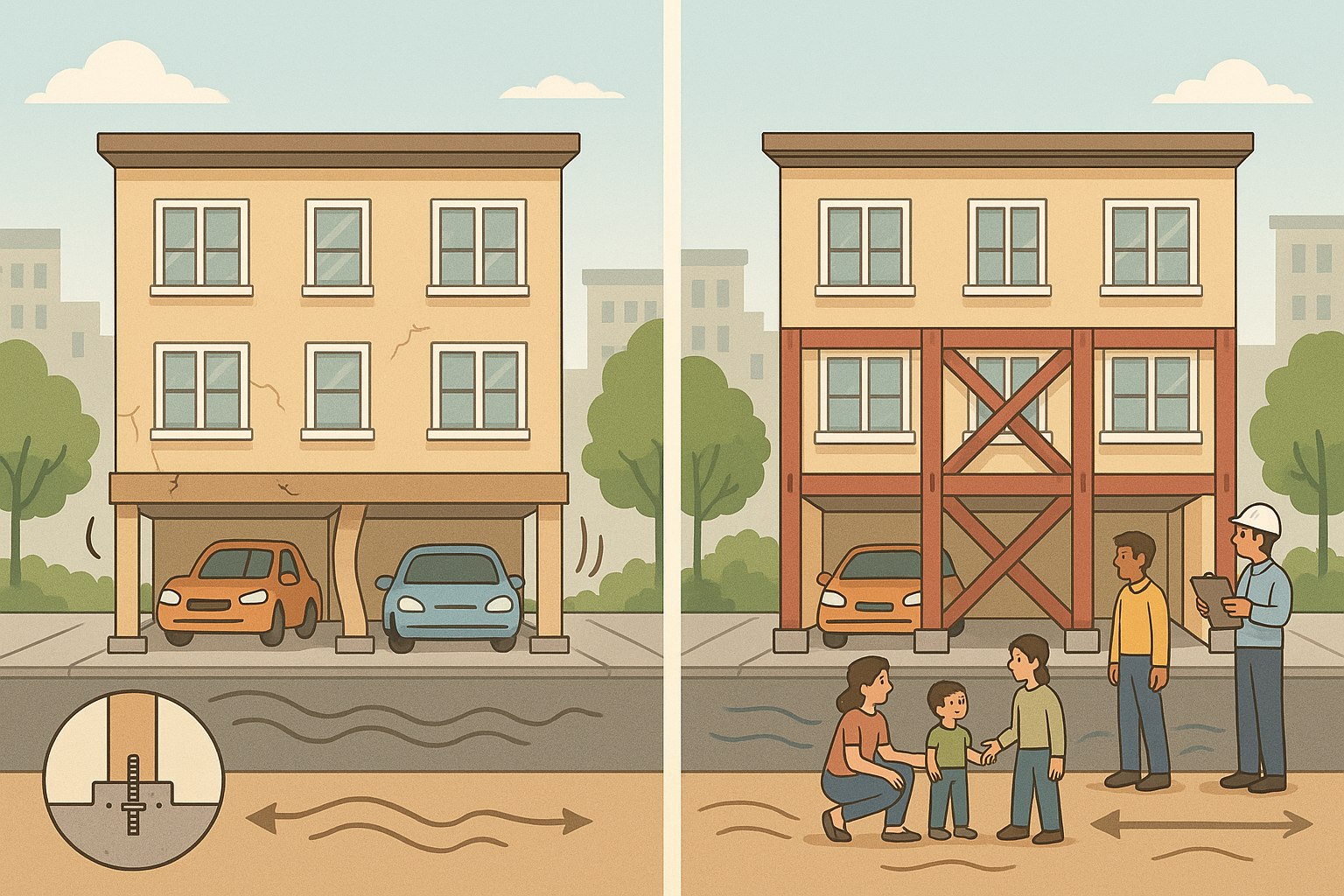

This isn’t just anecdotal — the shift is backed by hard data. According to recent reports from AirDNA and Redfin, some California cities have seen 30–50% declines in active short-term rental listings. Thousands of properties are being pulled from the short-term market and either converted into long-term rentals (especially in rent control-exempt properties like single-family homes, condos, and new construction), or listed the homes for sale, thus creating new inventory in the residential market and more options for buyers.

Impacts on the Multifamily Market

So what does this mean for the multifamily market? On the one hand, the increasing supply of homes for sale could soften overall housing prices, opening a window for renters who were previously priced out of ownership. That has the potential to convert long-term tenants into first-time homebuyers, which may reduce rental demand in some markets and apply downward pressure on rents.

But on the other hand, high interest rates remain a major obstacle. Even as inventory for single family homes slightly increases, monthly mortgage payments often remain higher than comparable rents, especially for those without substantial down payments. For many, it still makes more financial sense to lease — not to mention the flexibility and lifestyle benefits of renting.

And let’s not forget the limited new construction starts due to rising construction costs and financing challenges, which continue to restrict supply, propping up rental demand and keeping multifamily performance strong.

A Resilient Asset Class in Uncertain Times

While short-term rental hosts are being taxed, regulated, and priced out, multifamily owners have—at least for now—dodged the latest round of legislative heat. For once, apartment owners aren’t being targeted as the state’s go-to piggy bank for solving the affordable housing shortage and homelessness crisis — but let’s not get too comfortable. This policy shift underscores a familiar pattern: government overreach that hits small business owners, mom-and-pop landlords, and real estate entrepreneurs hardest, while shielding larger corporations and hotel chains from the same burden. Sound familiar?

Written by Mercedes Shaffer, Broker

Mercedes Shaffer is a multifamily broker with REAL, and If you have questions about buying, selling or doing a 1031 exchange, her team serves LA and Orange County and can be reached at 714.330.9999, InvestingInTheOC@gmail.com, or you can visit their website at InvestingInTheOC.com BRE 02114448