Solving The Occupancy Equation, Affecting Vacancy With Leasing Prospects And Closing Ratios

Leasing apartments is a skill for property management professionals. To forecast the results, there are two measurable factors: the number of leasing opportunities who make appointments or arrive at the property; and the number (percent) that commit to lease.

Explaining the financial impact of vacant apartments and the recovery period will assist in creating a sense of urgency for the staff to secure leases and move ins.

With average rents of $600, every day an apartment remains vacant, the property loses $20. This doesn’t seem to be an amount of lost revenue to cause concern. The same twenty dollars increases to $140 each week. With ten vacant apartments, the loss is $200 each day, totaling $6000 per month. The property quickly has accumulated 3000 days of vacancy loss.

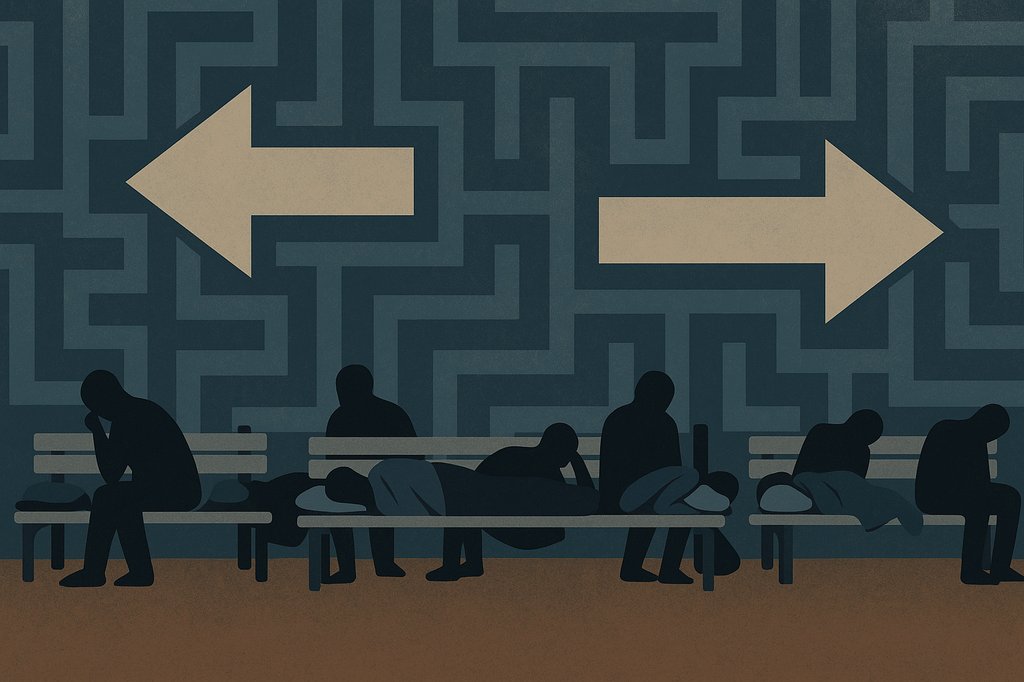

To increase move ins, the property needs more leases. This can be achieved by either increasing the number of leasing opportunities coming to visit the property or increasing the number of individuals who make the decision to lease.

Doubling the volume of visits to the property to 40 individuals will result in 8 leases. With this increased traffic, adding some closing tools; complimentary carport for a month, discounted security deposit, a structured follow up effort, the closing ratio could grow to 30%. This results in 12 leases. Occupancy can be back on track within thirty days instead of sixty, recovering a potential $6,000 into the revenue stream.

Without an adjustment to the number of visits or the leases secured, the number of vacant apartments lingers on resulting in a financial drain on the property. Setting goals for prospective leasing visits, securing commitments to lease and completing the move ins, will put the property on road to occupancy recovery.

|

Lori Hammond | Company Website | LinkedIn Connect |

Lori has 30+ years’ experience in the Property Management Industry, working with both market rate and affordable housing. Lori has been privileged to work with some tremendous industry leaders during employment tenures with Oxford Management, NHP Management, AIMCO, Alliance Residential, Boston Capital, The Sterling Group, P.K. Housing and currently Management Resources Development. |